This Week in Earnings – The Sector Beat: Consumer Discretionary

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Consumer Discretionary in “The Sector Beat”

Key Events this Week

Interest Rates

- The Federal Reserve held interest rates steady at their highest level in two decades and acknowledged recent inflation setbacks, extending a wait-and-see posture that could last well into the year. However, Fed Chair Jerome Powell said at a news conference that he didn’t think it was likely the Fed would need to consider interest-rate increases, and he volunteered that rate cuts could begin if the labor market weakened (Source: WSJ)

- Eurozone inflation held steady in April at 2.4%, in line with expectations. A crucial indicator that underlying price pressures slowed, solidifying an already strong case for the European Central Bank to cut interest rates in June. (Source: Reuters)

Employment

- U.S. job openings fell to a three-year low in March, while the number of people quitting their jobs declined, both signs of easing labor market conditions that over time could aid the Federal Reserve’s fight against inflation. Job openings were down 325,000 to 8.49M on the last day of March, the lowest level since February 2021 (Source: Labor Department)

- Total nonfarm payroll employment increased by 175,000 in April marking the smallest gain in six months as the unemployment rate ticked up from 3.8% to 3.9% (Source: Labor Department)

- Unit labor costs, or what a business pays employees to produce one unit of output after taking into account changes in productivity, climbed at a 4.7% annual rate. That marked a notable jump after muted gains in the second half of 2023. (Source: Labor Department)

Consumer Confidence

- The Conference Board’s U.S. consumer confidence index fell to 97.0 this month from a downwardly revised 103.1 in March, the lowest level since July 2022. (Source: The Conference Board)

Global Economies

- The Eurozone economy rebounded in the first quarter from a mild recession. GDP in the 20-country bloc increased by 0.3% QoQ and 0.5% YoY as Germany returned to growth and expansion accelerated elsewhere. (Source: Reuters)

- Hong Kong’s GDP expanded 2.7% in the first quarter from a year earlier, according to advance estimates from the government. That beat the median estimate for 1.5% growth, but was down from the 4.3% rise seen in the final quarter of last year. The economy lost steam as consumer and government spending weakened, but export strength helped growth beat consensus views. (Source: WSJ)

Housing

- U.S. home prices leapt in February by the most in nearly two years, reflecting the effects that lean home supply continues to have on the nation’s housing market. Prices climbed 1.2% in February from January, the largest sequential increase since April 2022. On a YoY basis, prices climbed 7%, the swiftest increase since November 2022. (Source: Reuters)

Earnings Snap

79% of the S&P 500 has reported earnings to date

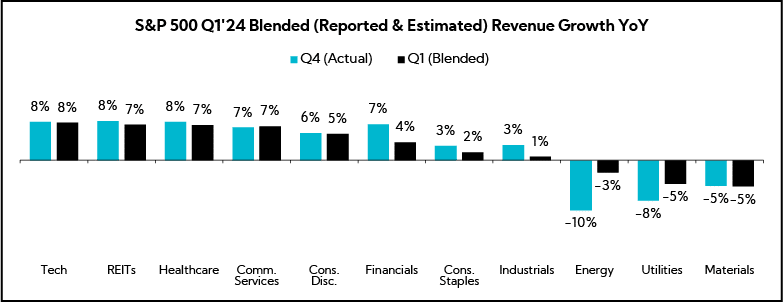

Q1'24 Revenue Performance

- 61% have reported a positive revenue surprise, below the 1-year average (67%) and the 5-year average (69%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 3.5%

- Companies are reporting revenue 0.8% above consensus estimates, below the 1-year average (+1.4%) and the 5-year average (+2.0%)

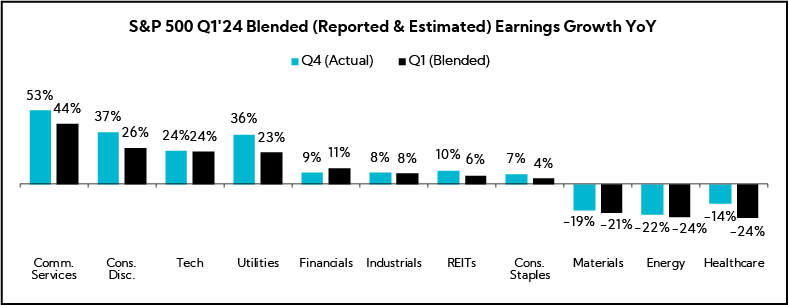

Q1’24 EPS Performance

- 77% have reported a positive EPS surprise, below the 1-year average (78%) and in line with the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 7.1%

- Companies are reporting earnings 8.4% above consensus estimates, above the 1-year average (+6.4%) and below the 5-year average (+8.5%)

The Sector Beat – Consumer Discretionary

Consumer Discretionary Trends

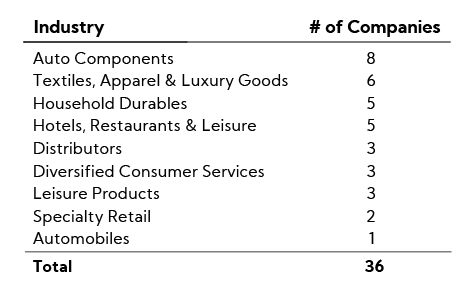

Each quarter, we analyze annual revenue and EPS guidance provided by Consumer Discretionary companies with market caps greater than $1B that have reported to date.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time a basket of companies larger than $1B in market cap across all sectors that have reported earnings to date (n – 275).

Guidance Breakdown by Industry

Revenue Guidance

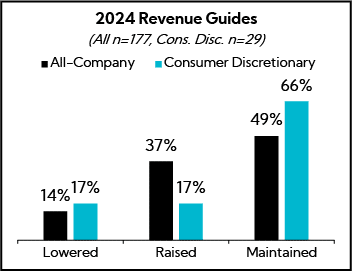

Revenue: Most ranges have been Maintained (66%) relative to last quarter, though 20% fewer have Raised outlooks compared to the All-Company benchmark (37%); midpoints assume 250 bps of growth, on average

EPS Guidance

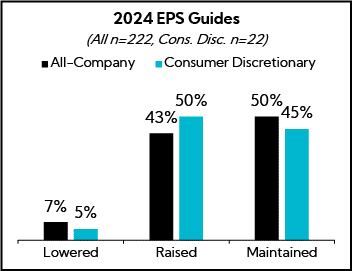

EPS: Most ranges were Raised (50%) relative to last quarter, 7% more compared to the All-Company benchmark (43%); spreads average $0.48

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Consumer Discretionary universe to identify key themes.

“Clearly, 2024 isn’t going to be a typical year for the broader industry.” That’s how the largest restaurant chain in the world — McDonald’s — began their earnings Q&A session this week after posting weaker-than-expected same-store sales growth and missing quarterly profit estimates for the first time in two years.

In fact, more broadly, McDonalds’ results were indicative of a wider trend in Q1 that suggested the consumer finally pulled back on spending — at least across large swaths of restaurants and retail providers.

Many observed a cautious consumer environment through the first three months of the year, leading to subdued traffic, sales, and a more competitive landscape overall, especially in regions like China where recovery has been slower than expected. Executives are observing “continued softness in consumer discretionary spend,” and a lower-income shopper that is being ever more discerning with their wallet.

Amid a softer demand environment, companies have been reluctant to pass on pricing increases, focusing instead on productivity and cost-saving measures — including layoffs — to protect profits. To that end, many are taking a conservative approach to inventory to mitigate risk among fluctuating consumer demand.

A consistent theme, labor costs emerged as a significant challenge for many companies. The employment cost index, an index tracked by the Labor Department which measures worker salaries and benefits, surged unexpectedly in Q1 to 1.2%. This increase exceeded the 0.9% rise observed in Q4’23 and surpassed consensus forecasts calling for a 1.0% gain, heightening concerns about persistent inflation. Simultaneously, consumer prices rose more than expected last month and consumer confidence dipped to its lowest point in nearly two years, suggesting that recent wage gains have not sufficed to alleviate lingering impacts of higher inflation.

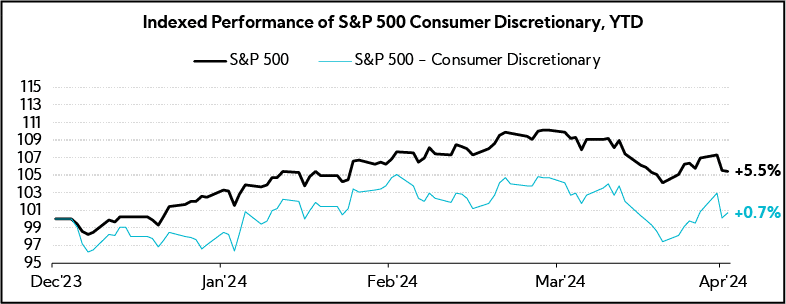

While the level of bearish sentiment toward Consumer Discretionary companies improved QoQ according to our latest Inside The Buy-Side Earnings Primer®, it registers second only to REITs as the sector with the most downbeat views overall for the fourth consecutive quarter. This comes as 35% expect Consumer Confidence to Worsen over the next six months, an increase from 23% registered in last quarter’s survey, and inflation being identified as a leading investor concern that more than tripled over the same period. Executive commentary this quarter did not aim to sugarcoat realities.

Key Earnings Call Themes

Executives, Particularly in Restaurants and Retail, Point to Acute Challenges in Store Traffic and Consumer Spending Patterns, Ultimately Culminating in “Conservative” Outlooks; Lodging and Leisure Remain Relative Bright Spots

- McDonalds ($9B, Restaurants): “The macro headwinds have been more significant than we even anticipated coming into the year and we continue to see those macro headwinds as we have started Q2. What we’re seeing is in many of our largest markets, internationally and the U.S., that the industry traffic is either flat or we’re certainly seeing declining trends.”

- Starbucks ($82.7B, Restaurants): “We face a challenging operating environment. Headwinds discussed last quarter have continued. In a number of key markets, we continue to feel the impact of a more cautious consumer, particularly with our more occasional customer. And a deteriorating economic outlook has weighed on customer traffic, an impact felt broadly across the industry. We still see economic volatility in the Middle East. But we remain confident in the region’s long-term growth opportunities. In China, we still see the effects of a slower-than-expected recovery, and we see fierce competition among value players in the market.”

- Carter’s ($2.5B, Apparel Retail): “Inflation and global turmoil continue to weigh on families with young children and their demand for our brands.With time, we expect inflation will moderate to desired levels, consumer confidence will recover, and market conditions will improve. Until then, we plan to forecast demand conservatively, stay lean on inventory commitments, fully invest in our growth strategies, and reduce discretionary spending where possible.”

- Genuine Parts ($21.8B, Auto Parts): “As we look to the broader macroeconomic environment, the start to 2024 continues to present a mix of challenges and opportunities. Higher interest rates and persistent cost inflation are pressuring businesses and consumers alike.”

- Hilton Worldwide ($49.4B, Lodging): “The broader economy is reasonably strong, seems to be very resilient. Obviously, employment numbers are quite good, corporate profits are still quite strong, the demand is great, the economy has been resilient, and employment has been strong; that all helps with the underpinning. While leisure certainly is normalizing from super high levels, it gives you a reasonable amount of confidence that it’s still going to be relatively strong.”

- Life Time Group Holdings ($2.7B, Leisure): “Honestly we have more demand than we are concerned about. I have personally expected to see some weakness for the last 18 months and I have been wrong. I have been wrong and wrong and wrong, and I kept thinking this customer is going to get tired, they’re going to get tired, we are not seeing anything.”

With Softness across Multiple Industries, Retailers Take Conservative Inventory Positions and Manufacturers Realign Production

- Gentex ($7.9B, Auto Parts): “There was definitely a little bit of pullback by OEMs. When we look at each of those OEMs, their deployment of the technology, how each OEM including some of our customers are talking about the fact they’re focusing on higher-end vehicles, trying to look at dollar content to help offset the fact that total light vehicle production may never come back to where it was, that suits us really well.”

- Lear ($7.2B, Auto Parts): “Global production decreased 1% compared to the same period last year and was flat on a Lear sales-weighted basis. Production volumes increased by 1% in North America and by 5% in China, while volumes in Europe were down 2%.”

- Mohawk Industries ($7.5B, Furnishings, Fixtures & Appliances): “Retailers have reported that consumers are reluctant to initiate higher ticket projects with flooring facing greater pressure since most replacements can be readily deferred. Our teams remain focused on managing through the near-term environment, realizing sales opportunities, reducing controllable costs and completing restructuring initiatives. We continue to manage our production levels to align inventories with market demand.”

- Pool Corporation ($13.7B, Industrial Distribution): “On the new construction side of our business, the continuation of economic uncertainty combined with elevated interest rates have weighed heavily on new pool starts. Our builders are reporting that consumers remain interested in pools, but as we have noted previously, lower-end pools remain a challenge, while demand for higher-end pools is steady, explaining the increased permit value on a per pool basis. Overall, we saw permits down 15% to 20% for the quarter, which is more than we anticipated for the year.”

- Coursera ($1.6B, Education & Training Services): “Consumer revenue was softer than anticipated. In particular, we underperformed in our North American region where we’re experiencing a lower volume.”

- Columbia ($4.7B, Apparel Manufacturing): “Overall, North America remains our most challenging market. We are facing several headwinds in this market, including consumers continuing to grapple with inflationary pressures, which is impacting soft goods demand. Traditional outdoor category trends are weak particularly in footwear. And retailers are taking a cautious approach in placing future season orders.”

Consumers are “Very Discriminating” with Where They’re Spending Their Remaining Nest Egg Due to the Compounding Effects of Inflation; Many are Focusing on Value and Carefully Managing Discretionary Spend

- McDonalds ($197.6B, Restaurants): “The consumer is certainly being very discriminating in how they spend their dollar, and the inflation that has occurred over the last couple of years in the U.S. has certainly created that environment. While it may be more pronounced with the lower income consumer, I think it’s important to recognize that all income cohorts are seeking value.”

- Newell Brands ($3.3B, Household & Personal Products): “The external environment remains challenging, as we expected. The categories we compete in remain under pressure with consumers continuing to carefully manage their discretionary spend as the cumulative impact of inflation on food, energy, and housing cost has outpaced wage growth.”

- Carter’s ($2.5B, Apparel Retail): “Spending was lower than planned. With consumers more cautious on discretionary spending, we also curtailed spending where possible. In this inflationary cycle, we believe consumers are shopping for apparel closer to need, making do with what’s in the closet until the seasons change. We believe families with young children continue to be adversely affected by the higher cost of living. In the first quarter, we saw a noteworthy increase in the use of credit cards and a decrease in debit cards. Current market conditions are not as good as we envisioned earlier this year.”

- Starbucks ($82.7B, Restaurants): “In this environment, many customers have been more exacting about where and how they choose to spend their money, particularly with stimulus savings mostly spent. We saw this materialize over the quarter as customers made the trade-offs in food away-from-home to food at-home.”

- Amazon ($1861B, Internet Retail): “We remain focused on making sure we’re offering everyday low prices, which we know is even more important to our customers in this uncertain economic environment. As our results show, customers are shopping but remain cautious, trading down on price when they can and seeking out deals.”

Companies Have Crossed the Rubicon…Levels Have “Rightsized”

- Newell Brands ($3.3B, Household & Personal Products): “From a retail inventory perspective, we believe that retail inventories are rightsized. So, we’re not seeing any significant impact from retail inventory changes to our top line. And we don’t expect any significant retail inventory headwinds or tailwinds as we go through the balance of the year.”

- Carter’s ($2.5B, Apparel Retail): “We continue to run leaner on inventories. Inventories were much lower at the end of the quarter and the quality of our inventories is higher. With less excess inventory, we saw a significant reduction in low margin off-price sales.”

- Columbia ($4.7B, Apparel Manufacturing): “We’re very proud of [ the 37% reduction], especially in relation to the gross margin we were able to achieve. There’s still more room for us to improve our inventory utilizations. We’ve updated our inventory turns up to about 3. And we see great opportunities with the automation we have in place now around estimating our demand and actualizing the demand according to the plan.”

- Pool Corporation ($13.7B, Industrial Distribution): “As we planned, inventory levels continued to normalize, finishing the first quarter…lower than Q1 last year. Our inventory days on hand have reduced from 142 to 132, and we expect to continue seeing this trend of lower comparative days as we lap last year’s higher inventory levels through third quarter.”

- Steven Madden ($2.8B, Footwear & Accessories): “Our fourth key business driver is strengthening our core U.S. wholesale footwear business. This business was under pressure in 2023, as many of our largest wholesale customers entered last year with too much inventory and reduced orders significantly in order to rightsize inventory levels. Fortunately, those wholesale customers have much healthier overall inventory levels this year. And as expected, we were able to return to YoY growth in the U.S. wholesale footwear business in the first quarter.”

- Skechers ($10.2B, Footwear & Accessories): “Our wholesale sales increased 9.8%, reflecting a return to growth in both international at 11% and domestic at 7.7%. We believe our inventory levels are healthy and comprised largely of proven sellers, fresh innovations, and new product categories.”

While Some Executives Highlight Moderating Input Costs, Many Point to Rising Labor and Exhibit Overall Hesitation to Implement Additional Pricing Adjustments; Companies Focus on Productivity, Automation, and Staff Reductions to Maintain Profitability

- Carter’s ($2.5B, Apparel Retail): “We saw an expansion of our gross profit margin in Q1, which reflects the benefits of lower product costs and lower inbound freight costs.”

- Gentherm ($1.7B, Auto Parts): “Gross productivity at the factories created a margin expansion of 170 bps. Fit-for-Growth specifically around sourcing savings and value engineering was 160 bps of margin expansion. And then we had a little bit lower freight cost about 20 bps. And these were offset by wage inflation, which is about 120 bps drag.”

- Domino’s Pizza ($18.5B, Restaurants): “We are expecting supply chain margins to be roughly flat compared to the prior year, incorporating an inflationary food basket for the rest of the year, with a full year range of up 1% to 3%. Should our food basket pricing for the year move to the lower end of our expectations, we may see modest leverage in operating and supply chain margins.”

- Yum China Holdings ($14.4B, Restaurants): “Cost of labor was 25.4%, 80 bps higher YoY, or 60 bps higher on a comparable basis. This was mainly due to last year’s wage increases for frontline staff and higher rider cost as the delivery mix went up. We improved our labor productivity, which more than offset the sales leveraging impact.”

- Lear ($2B, Auto Parts): “The level of component cost inflation that we’re seeing this year is less than what we’ve experienced over the last number of years. So you’re seeing some moderation on the commodity side and then maybe some acceleration on the labor side. And the two are slightly positive when taken together overall.”

- McDonalds ($196.9B, Restaurants): “If I focus just on the U.S., most of the pricing that you see now…is carryover pricing. It’s not new pricing per se. That said, we do continue to see…labor inflation. Much of that is coming out of what happened in California and on a national level you could probably see, we’re expecting high single-digit labor inflation. Again, much of that from the bleed-over of what California introduced, and then on food and paper inflation, that’s gone down to much more historical levels.”

- Newell Brands ($3.3B, Household & Personal Products): “We have a little bit of carryover pricing from the pricing action that we took in the U.S. from July 1st last year to address the structurally unattractive parts of our portfolio that is providing a benefit in the U.S. in the front half of this year from a pricing perspective from a carryover standpoint. We are not planning and have not announced major new pricing actions this year although we still are experiencing sort of low single-digit input cost inflation largely driven by labor, overhead and resin primarily.”

- Mohawk Industries ($7.5B, Furnishings, Fixtures & Appliances): “Lower market demand and consumers trading down are creating a competitive marketplace, pressuring average selling prices and product mix.”

Productivity and Cost Savings

- Newell Brands ($3.3B, Household & Personal Products): “What we’re hearing from retailers is they’re asking us about, hey, is there a chance to roll back pricing? And our response has been that we’re still seeing inflation in low single-digits. And so, we’ve generally said we’re going to offset that low single-digit inflation with productivity, which more than offsets it. But our plan is not to reduce prices in the market.”

- Lear ($7.2B, Auto Parts): “We continue to evaluate additional tools to accelerate automation in our plants. And yesterday, we announced the acquisition of WIP Industrial Automation. WIP is a European supplier that leverages AI, vision systems and robotics to develop turnkey solutions to complex industrial problems. WIP’s technology can be used in multiple applications in Seating and E-Systems and expands our automation footprint in Europe.”

- Autoliv ($9.7B, Auto Parts): “To secure our medium- and long-term competitiveness and to support our financial targets, we launched a cost reduction initiative in mid-last year with the intent of reducing our indirect head count by up to 2,000. We estimate that the annual cost reduction will amount to around $130M when fully implemented, with around $50M already in 2024 and around $100M expected in 2025. We are already seeing a positive impact on direct labor productivity as a result of our initiatives to reduce the direct workforce by the equivalent of up to 6,000.”

- Columbia ($4.7B, Apparel Manufacturing): “We’re on track to deliver between $125M and $150M in savings by 2026, including $75M to $90M in cost savings this year. We are eliminating expenses associated with carrying excess inventory and driving cost efficiencies throughout our supply chain. We’ve also begun realizing indirect spend savings. During the quarter, we completed a reduction in force.”

Remains a Challenging Market, Albeit Improving for Some; Executives Reinforce the “Long Game”

- Yum China Holdings ($14.4B, Restaurants): “We anticipate a tough Chinese New Year, because it was very high base. The situation was unique last year with the reopening and then there’s pent-up demand on traveling and then, also we are a bit more well-prepared with the store opening than our peers. For the 2024 Chinese New Year, we see the return to normal trading with more store available for consumer.”

- Gentex ($7.9B, Auto Parts): “The biggest challenges we have are, if something’s produced completely in China and then exported, there’s obviously the geopolitical side of the tariff structure right now that puts us at a little bit of a disadvantage and so we’ll have to get more creative if we want to capitalize on those opportunities in the domestic China market.”

- Skechers ($10.2B, Footwear & Accessories): “The China story for us continues to be one of a pretty strong recovery, all things considered. We’re incredibly pleased with what we saw in China this quarter. And it reflects a lot of work by our team there to succeed, despite some of the challenges that persist. As we look at the balance of the year, we remain cautiously optimistic that we’ll continue to see more of that recovery. Keep in mind, China’s a growth market. We think it has a lot of opportunity long-term for the brand. We remain optimistic, albeit cautiously, about the future.”

- Starbucks ($82.7B, Restaurants): “Turning our attention to China, macro pressures resulted in traffic contraction this quarter. Performance was impacted by decline in occasional customers, changing holiday patterns, a highly promotional environment and a normalization of customer behaviors following last year’s market reopening. Like the U.S., our decline in occasional customers was most noticeable in the afternoons and evenings. We will weather through this dynamic and transitory period as the industry shakeout continues. Our confidence in the market opportunity and our ability to deliver remains unwavering as we play the long game in China.”

In Closing

There is a noticeable change in executive tone this quarter — one of more caution — as much of the sector grapples with fluctuating and bifurcating consumer buying habits, with pronounced pullbacks this quarter in discretionary spending evident across several industries, including dining and retail. Much hinges on the consistently strong employment environment, though we continue to see a bevy of layoffs as companies manage profitability in a slowing growth environment and as pricing power has slowed at the same time labor costs are climbing.

We will continue to monitor these trends and more as we seek to support you, our valued clients, and as we work through the quarter and the rest of the year.

- As of 5/1/24

In case you missed it, you can access the link below for a replay of our Inside The Buy-Side® Earnings Primer® webinar The Big So What™ – Q1’24 Earnings Season. Thank you to all who attended the session live and submitted questions!