Commencing the Quarter – Q1’24

With earnings season kicking off shortly, our Thought Leadership this week covers:

- Key Events this week

- Q1’24 Earnings Communication Playbook, based on our channel checks, identification of emerging trends, and review of company earnings to date

Key Events

Employment

- Nonfarm payrolls increased by 303,000 jobs last month, significantly more than the 200,000 economists expected. The unemployment rate slipped to 3.8% versus February’s 3.9%, in line with expectations. Average hourly earnings in March rose 0.3% from the previous month and 4.1% YoY, marking the smallest on-the-year gain since June 2021. (Source: Labor Department)

- Private payrolls increased 184,000 in March, the most since July and outpacing median estimates +150,000. Wage growth continued to accelerate for those who changed jobs, rising 10% YoY and the largest advance since July. Workers who stayed in their job saw a 5.1% median pay bump in March YoY, though this remained unchanged from the prior month. (Source: ADP)

- Initial jobless claims, a proxy for layoffs, increased by 9,000 to 221,000 last week while the four-week moving average for jobless claims rose 2,750 to 214,250; continuing claims, which reflect the number of people seeking ongoing unemployment benefits, fell to 1.79M, down 19,000 from the week before. (Source: Labor Department)

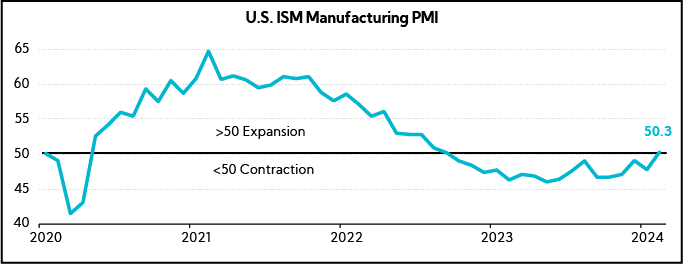

Manufacturing

- United States: U.S. factory activity unexpectedly expanded in March for the first time since September 2022 on a sharp rebound in production and stronger demand. The Institute for Supply Management’s manufacturing gauge rose 2.5 points to 50.3 last month, halting 16 straight months of shrinking activity. (Source: Bloomberg)

- China: China’s factory activity beat expectations in March, rising to 51.1 — the fifth consecutive month the index has been above 50 (expansion territory) and the longest streak in more than two years according to the Caixin manufacturing PMI. (Source: Bloomberg)

Geopolitics

- President Biden called for an immediate cease-fire in Gaza during a phone conversation with Israeli Prime Minister Benjamin Netanyahu on Thursday, which came days after seven aid workers were killed. The White House account signaled a more confrontational approach from Biden toward Netanyahu and suggested for the first time that the White House could reassess its assistance and political support for Israel. (Source: WSJ)

Q1’24 Earnings Communication Playbook

As we do every quarter, we analyzed the earnings communication trends of 30 off-cycle companies reporting between March 6 and April 5, 2024, to identify important themes and precedence. These companies span market cap sizes and sectors.

In line with findings from our Inside The Buy-Side® Earnings Primer® — to be released next week — commentary from earnings call thus far reveal a cautiously optimistic tone among executives. Many have progressed from the recessionary woes voiced merely a quarter ago and are now grounding their perspectives in the notion that the economy is gliding toward a soft landing.

There are still mixed signals across the board from management commentaries on inflation depending on where their companies sit within the economy, though many described conditions as improving relative to last year. Companies continue to underscore efforts to enhance margins through process optimization programs and strategic pricing, where possible. Further, AI was mentioned in half of prepared remarks across sectors, specifically regarding AI-driven demand benefits and operational efficiencies.

All of that said, commentary has come with its fair share of canaries. A recent slew of downbeat results from consumer-facing companies implies that the previously steady pillar of market optimism for the past several quarters — the consumer — might be facing increased challenges, at least in the near term. While the rate of inflation has come down significantly, the cumulative effects of price increases on consumer goods and services continue to whittle away at discretionary income. Separately, analysts and corporates spent more airtime this quarter on shipping complications, predominantly as they relate to the endemically conflicted Middle East, but also as a result of the Baltimore bridge collapse last week.

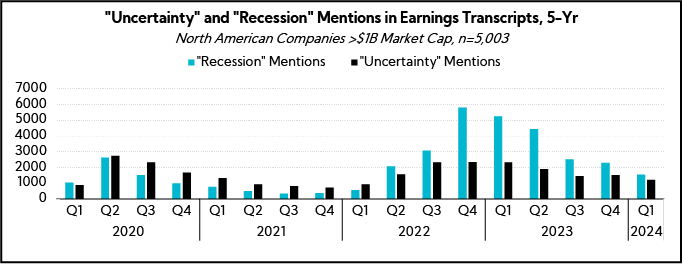

These concerns aside, one thing is clear: in general, outlooks thus far are being communicated with more confidence. Empirically, executive mentions of “recession” and “uncertainty” within earnings transcripts declined 70% and 48%, respectively, through the first three months of the year versus 2023, and overall paint a clear downtrend relative to prior quarters. Time will tell if this trend continues, but this shift suggests a growing assurance among executives about their business forecasts and the trajectory of the U.S. economic environment — both the good and the bad.

Earnings Topics

Key trends from our analysis of 30 off-cycle earnings calls include:

Executive Forecasts Skew Cautiously Optimistic Amid “An Economy That Seems to Have Better Footing”, Fewer Headwinds, and Easier Comps; Many Have Left Recessionary Concerns Behind

- Paychex ($43.6B, Industrials, Staffing & Employment Services): “What we see is a moderating economy. We see a stable economy. We don’t see signs of a recession. Demand was strong.Our pipeline was strong. The other things that you would typically see that would be more recessionary, we’re not seeing mass layoffs. What we’re seeing is openings, vacancies, troubled hiring, and businesses being cautious in who they’re bringing into their workforce.”

- H.B. Fuller ($4.2B, Basic Materials, Specialty Chemicals): “Our outlook assumes manufacturing activity will be weak through the end of the year. However, from a YoY comparison standpoint constrained manufacturing activity will be more than offset by the absence of the destocking impact that weighed so heavily on 2023 volume.”

- RPM International ($14.6B, Basic Materials, Specialty Chemicals): “We don’t see any huge snap back per se, but we will be rounding easier comparisons as we get into fiscal 2025. Some of this is a long tail rebalancing from the boom in COVID, and some of it is the simple fact that, while broadly speaking, perhaps we’re avoiding a major recession, the manufacturing sector has gone through a rolling recession. Anything that touched housing has gone through a rolling recession.”

- Micron Technology ($136.3B, Technology, Semiconductors): “It helps that the economy seems to have better footing as well. Most of the concerns around recession, etc., that were there last year have abated.”

- Distribution Solutions Group ($1.7B, Industrials, Industrial Distribution): “The best example of [optimism for a better second half of 2024] is just seeing the book-to-bill on some of the markets that have been more sensitive to inflation or to interest rates like the renewables. So, the renewables have the highest book-to-bill currently of any of the markets that we serve. And that in and of itself, to me, is an indication that there’s confidence in that end market which has been probably the most sensitive of our end markets to interest rates and the overhang or concern about a recession.”

Reflecting a Slow Start to the Year for Retail, Consumer-Facing Companies Point to Continued Value-Seeking Shopping Habits through Q1

- Walgreens Boots Alliance ($16.2B, Healthcare, Pharmaceutical Retailers): “Within retail, our U.S. customer is confronting considerable pressure from multiyear inflationary trends and depleted household savings, with U.S. household debt at record levels and delinquency rates on the rise. Our shopper is making deliberate choices to seek value, resulting in channel-shifting behavior. We’re responding to these market dynamics by making investments in key value items and focusing our capabilities to engage with customers in an intelligent, targeted way.“

- McCormick & Co ($20.3B, Consumer Defensive, Packaged Foods): “Consumers remain challenged; two years of steep inflation has had an impact, and many are exhibiting value-seeking behavior. While food inflation is slowing, its compounded impact is still being felt by consumers. Budgets are stretched, resulting in choiceful spending decisions, a trend that is continuing from Q4. In Q1, with higher inflation in the foodservice channel and slowing retail food prices, we broadly saw a shift from food-away-from-home to food-at-home consumption in our major markets. We are also seeing improvement in center store categories and some softness in restaurant traffic across all regions.”

- Burlington Stores ($12.9B, Consumer Cyclical, Apparel Retail): “We continue to see strong selling at our opening price points. The lower income customer, the need-a-deal shopper, is responding well to these values. This is a very important customer for us. A year ago, this shopper was really struggling with a higher cost of livingand with the loss of pandemic era benefits. This customer is still fragile. The cost of living is not declining, it is just going up less quickly. That said, this represents an improvement versus last year.”

- PVH Corp ($6.2B, Consumer Cyclical, Apparel Manufacturing): “We have taken a cautious approach to planning 2024 [revenue down 6% to 7%] due to the softening consumer backdrop we saw in January and February and a conservative wholesale environment.”

- Lululemon Athletica ($44.9B, Consumer Cyclical, Apparel Retail): “As you’ve heard from others in our industry, there has been a shift in the U.S. consumer behavior of late, and we’re navigating what has been a slower start to the year in this market. We’re seeing a slowdown in traffic in the U.S., but it’s still positive. And conversion is down slightly.”

- Campbell Soup ($12.9B, Consumer Defensive, Packaged Foods): “Consumers continue to prioritize value, as shown by their preference for home-cooked meals, purchasing food that helped them prepare stretchable meals and smaller and less frequent shopping trips.”

Execs Continue to Tackle Pockets of High Costs, Including Labor, Though Many Assert Conditions Have Largely “Moderated” Versus Last Year; Still, “Costs Are Not Going Backwards” and Companies are Countering with Pricing Where Possible and Optimization Efforts

- Unifirst ($3.1B, Industrials, Specialty Business Services): “With respect to pricing, my comments probably hold from last quarter. It is a little bit more sensitive out there. You just look at the cycle that we’ve gone through from an inflationary perspective and, although costs are not going backwards, some of the cost trends out in the marketplace have moderated.”

- Conagra Brands ($14.9B, Consumer Defensive, Packaged Foods): “Obviously, inflation has slowed, but we’re still in an overall inflationary environment and some things more recently have inflated, and that has led to taking some price. You have a bit of a lag effect, so you get a little bit of margin pressure in the early days while you’re waiting for that to get reflected.”

- Campbell Soup ($12.9B, Consumer Defensive, Packaged Foods): “Core inflation in Q2 was low-single-digits. We continue to expect core inflation to stay within this low-single-digit range for the remainder of fiscal 2024, down from the double-digit range last year. We continue to deploy a range of levers to mitigate remaining inflation, including supply chain productivity improvements and broader margin-enhancing initiatives.”

- Progress Software ($2.2B, Technology, Software – Infrastructure): “We continue to see inflation running through from a cost perspective… that’s still a bit of a challenge for us and for a lot of companies out there. We’re pretty good at managing costs and being forward looking in terms of how our cost profile is going to develop. We’re going to have to continue with that because we still see some of the same inflationary pressures in the market and in our business.”

- Core & Main ($11.8B, Industrials, Industrial Distribution): “Operating costs for us are highly variable. But, we have experienced labor cost inflation, definitely inflation across a lot of our other facility and distribution costs. And some of that has even lagged our ability to get some of that price into the market, so we’re seeing more of that pressure show up. As we experience some of the margin normalization that we’re anticipating in the back half, we have a lot of costs that comes out relatively quickly, given our variable cost structure with our incentive comp plans.”

- MSC Industrial ($5.4B, Industrials, Industrial Distribution): “We have created a Commercial and Operational Excellence Group tasked with working closely with [our] business units to identify, benchmark, quantify and realize margin enhancement opportunities. Our optimization efforts are still in early stages but already many concrete opportunities have been found, both at individual businesses and across the enterprise.”

With Red Sea Disruptions in Full Swing and Added Freight Pressures Stemming from the Collapse of the Francis Scott Key Bridge in Baltimore, Shipping and Logistics Are Top of Mind Among Analysts and Executives

Analyst Questions

- “How are you thinking about the impact from this Red Sea disruption to both your European and U.S. businesses? I’m trying to find out if you’re incorporating any freight headwind in the back half of the year?”

- “I am curious if there’s any expected impact from any supply chain friction, whether that’s from shipping lane dynamics, from stuff coming over the water, or maybe even this Baltimore bridge, which I’m guessing is still maybe a non-event as of now. How do you think about transport and logistic costs flowing through the income statement into the back half?”

- “Have you seen any pressure on future costs related to what’s going on in the global supply chain network with the Red Sea, the Panama Canal issues, all those kinds of things?”

Executive Commentary

- G-III Apparel Group ($1.3B, Consumer Cyclical, Apparel Manufacturing): “We are a little bit concerned about the Red Sea. It has not impacted us just yet outside of our European distribution, which it has impacted We do anticipate that will be a little bit of a headwind for us. Hopefully, it doesn’t become too great.”

- RH ($5.2B, Consumer Cyclical, Specialty Retail): “Revenue was negatively impacted by $40M in Q4 due to the severe January weather and shipping delays related to the ongoing conflict in the Red Sea. We do expect the majority of the deferred revenue will be realized in 2024 when transit times normalize.”

- MSC Industrial ($5.4B, Industrials, Industrial Distribution):“The Baltimore situation is so new and so tragic, too early there to say. But, we’re monitoring closely events in the Middle East and some of the supply chain disruptions. I would say so far, impact is projected to be modest. Obviously, that could change. But, to-date, we have a lot of focus on freight.”

Across Sectors and Industries, Executives Speak to the Tangible Benefits of a World Captivated by AI

- TD SYNNEX ($10.2B, Technology, Electronics & Computer Distribution): “We believe that the IT spending environment will continue to improve throughout the year and believe we will return to positive YoY gross billings growth next quarter, bolstered in part by the introduction and growth of infrastructure components and services to support escalating AI-enabled workloads and applications.”

- Jabil ($17.5B, Technology, Electronic Components): “In the healthcare industry, we’re in the early innings of getting our arms around the benefits of AI in the operating room. And in our cloud business, we’re seeing significantly increased demand for our services related to AI, specifically to hardware, manufacturing, and design. And perhaps most exciting, this enthusiasm is beginning to turn into tangible results. For instance, our AI GPU volume in the first half of 2024 is 200x that of the level of 2023.”

- Darden Restaurants ($18.8B, Consumer Cyclical, Restaurants): “If you think about what we’ve been doing over the years, we’ve been improving our technology on guest count forecasting by using machine learning and AI tools to help the brands write better schedules and manage their business better. And we’re able to react quicker to impacts that we see in our restaurants, but we’re also continuing to find ways to improve productivity.”

- Five Below ($9.1B, Consumer Cyclical, Specialty Retail): “We’ve been on a streamlined process for quite some time; we’re using Placer AI now to help us evaluate stores, which allows us to do it quicker. The legal team has streamlined how quickly they’re able to approve leases. All those add up to weeks not days [of improvement].”

- John Wiley & Sons ($2.2B, Communication Services, Publishing): “Today, we are actively building and deploying AI editing tools to improve speed and quality of our journal content and reduce unit costs through process automation in the value chain. For example, we recently launched an internal pilot of our AI powered article matching engine to help authors get published faster and in the right journals.”

Perspectives Vary by End Market, Culminating in Cloudy Outlooks Overall, but with Rays of Light for Some

- McCormick & Co ($20.3B, Consumer Defensive, Packaged Foods): “In Asia Pacific, volume performance was impacted by the macro environment in China, as we expected. We continue to expect full-year 2024 China Consumer sales to be comparable to 2023.”

- Steelcase ($1.5B, Industrials, Business Equipment & Supplies): “In Asia Pacific, we had double-digit order growth again this quarter, which was driven by India, Japan, and Australia, partially offset by continued softness in China.”

- Levi Strauss ($8.3B, Consumer Cyclical, Apparel Manufacturing): “While a relatively small business for us, we experienced a slower than expected recovery in China. We have several initiatives in place to improve our business performance in this market, including ramping up a local product engine.”

- General Mills ($39.4B, Consumer Defensive, Packaged Foods): “In our International segment, China net sales declined due to continued macroeconomic pressure, as well as lapping elevated at-home demand in December and January of our last fiscal year. The other driver though is store traffic in China is down a little bit from where it had been before, and that’s probably a function of the Chinese consumer feeling the tension of an economy that has slowed down over the past year.”

- H.B. Fuller ($4.2B, Basic Materials, Specialty Chemicals): “We continue to remain optimistic about our business in China. With no direct exposure to the Chinese construction market and strong representation in the electronics and automotive market segments [over there], we’re encouraged by what we’re seeing. And while we expect some uneven market activity over the near term, we will continue to grow through innovation share gains in our select markets of choice.”

- Victoria’s Secret ($1.4B, Consumer Cyclical, Furnishings, Apparel Retail): “Our international business continued its strong performance with system-wide retail sales up more than 20% in the fourth quarter compared to last year, driven by significant growth in China.”

- Millerknoll ($2.0B, Consumer Cyclical, Furnishings, Fixtures, & Appliances): “The great news about our international business is that it is very diverse. So, if you still struggle in Europe, then you have China that’s beginning to wake up to offset that. So, we have markets, as we mentioned over the last several calls, Middle East, India, Asia and China starting to wake up that are really kicking in. And that stability has driven the business forward.”

- Lululemon Athletica ($44.8B, Consumer Cyclical, Apparel Retail): “We remain excited about the potential for Lululemon in China. In Q4, our revenue increased 78% in Mainland China. Part of that was driven by the COVID-related store closures we experienced in quarter 2022. But in the full year, our business grew 67%. So, while we’re keeping a close eye on the macro environment in the region, our business remains very strong, and we believe several factors benefit us in China.”