Q2'24 Inside The Buy-Side® Earnings Primer®

Closing the Quarter Q3’23

With Q3 2023 earnings season in the books, we “Close the Quarter” with some notable themes:

Overall Performance

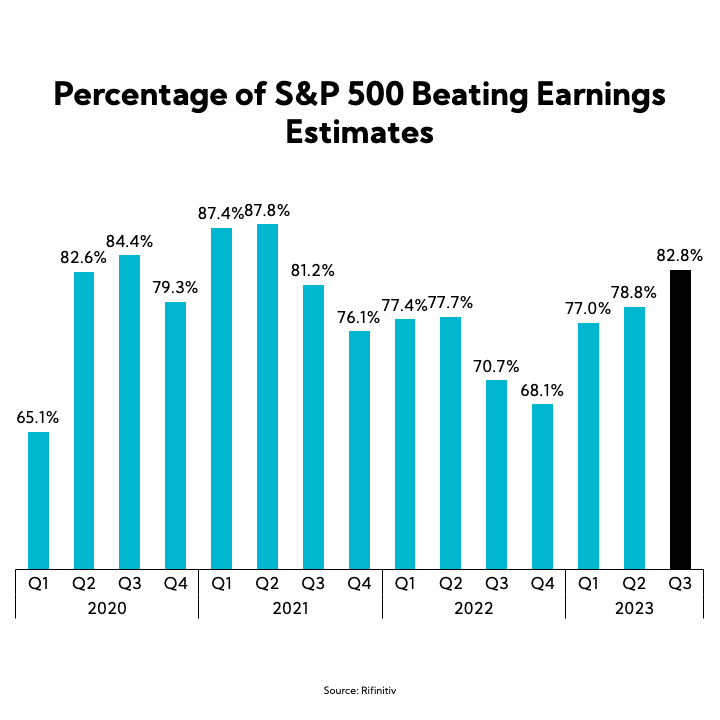

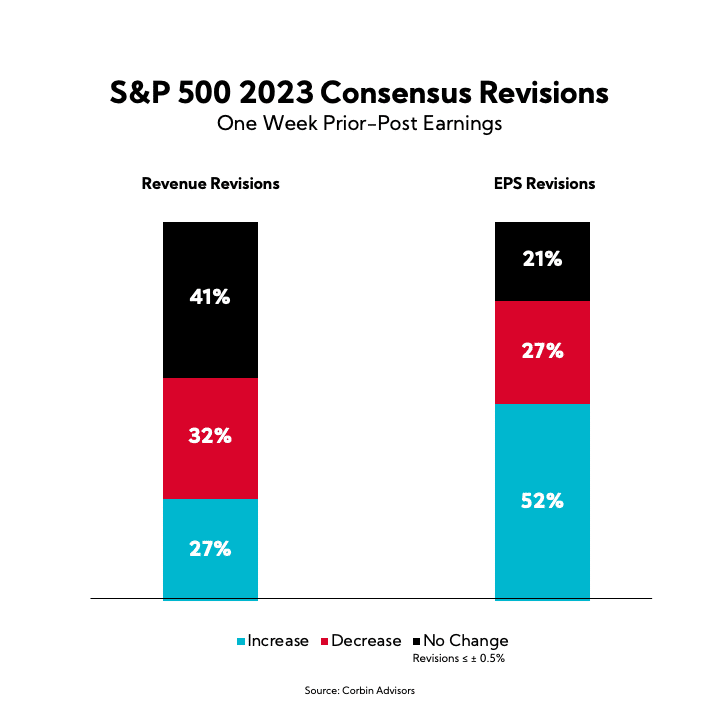

Stronger-than-expected S&P 500 Q3 EPS prints (~83% beat vs consensus) result in more than half of companies seeing estimate increases through the end of the year, while roughly one-third experience revenue expectation cuts despite 60% beating consensus.

Consensus Trends

- Revenue: 27% increase, 41% no change, 32% decrease

- EPS: 52% increase, 21% no change, 27% decrease

Guidance

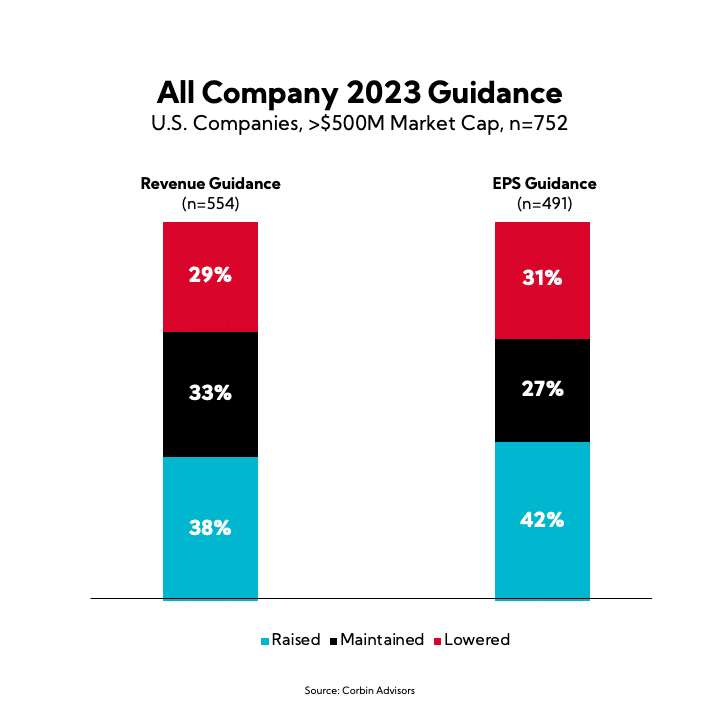

Based on a universe of over 750 companies we track every quarter, more companies raised guidance versus maintained or lowered, with EPS seeing a slightly higher number of increases over revenue.

Guidance Shifts

- Revenue: 38% raised, 33% maintained, 29% lowered

- EPS: 42% raised, 27% maintained, 31% lowered

Capital Allocation

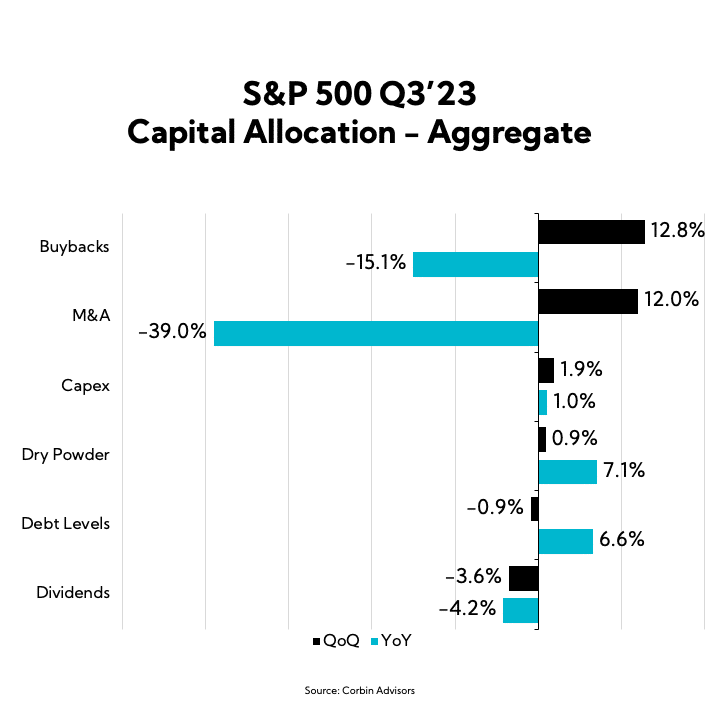

Sequential cash uses indicate renewed interest in buybacks and M&A, though both increases continue to be overshadowed by their negative YoY comparisons.

S&P 500 Sequential Uses of Cash

- +12.8% buybacks

- +12.0% M&A

- 1.9% capex

- +0.9% dry powder

- -0.9% debt paydown

- -3.6% dividends

Earnings: Stronger-than-expected Q3 EPS prints result in consensus raises through the end of the year, while roughly one-third cut revenue expectations.

Guidance: More companies across the broader U.S. universe are raising annual EPS guidance than they are revenue for 2023, though both metrics saw the majority of companies increasing. Still, roughly 30% decreased top- and/or bottom-line guides through Q3.

Corbin Advisors is a strategic consultancy accelerating value realization globally. We engage deeply with our clients to assess, architect, activate, and accelerate value realization, delivering research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset.

Capital Allocation: Sequential cash uses indicate renewed interest in buybacks and M&A, though both increases continue to be overshadowed by their negative YoY comparisons.

Outlook

Despite continued consensus beats, which can give an illusion of strength, outlooks are mixed, at best, and executive commentary is increasingly cautious amidst pervasive uncertainty

- Geopolitics: Executives continue to express caution as the latest injection of geopolitical uncertainty further weighs on sentiment; “there are reasons to remain vigilant”

- Growth: Reduced discretionary spending is amplified by reluctance to restock inventory, with executives warning of mixed signals through the beginning of Q4

- Margins: Despite lower demand and signs of downward pricing pressure, companies largely hold firm on margin rates, helped by pockets of deflation

- Consumer Health: Consumers pull the purse strings tighter; executives point to leaner spending habits and trade-down activity, particularly among lower income shoppers, as the compounding effects of inflation, debt, and student loan payments weigh on sentiment

- China: Companies report mixed performances and ongoing geopolitical tensions as factors marring results; even companies with longstanding ties to the country continue to redirect new investment towards alternative regional substitutes

- Europe: Executives see some encouraging signs and cite stable demand (albeit, more moderate than the U.S.); inflation and geopolitical uncertainty remain significant headwinds

Partner with Us

Leverage the experience and expertise of our team.

A strategic consultancy accelerating value realization globally

About Corbin

Advisory Solutions

- Earnings

- Environmental, Social, and Governance (ESG)

- Initial Public Offering (IPO)

- Investor Days

- Investor Presentations

- Investor Relations Advisory

- Investor Relations Immersion

- Investor Targeting & Marketing

- Research as a Service (RaaS)

- Strategic Communications Gap Analysis

- Strategy & Communications

- Voice of Investor® Perception Studies

Subscribe to Inside The Buy-Side®

Access insights in our regularly published research, which captures trends in institutional investor sentiment globally.