Industrial Investors Brace for Disappointing 2H24 amid Anticipated Misses and Downward Guidance Revisions; Sights Turn to 2025 for Which Optimism is Building

Q3'24 Inside The Buy-Side® Earnings Primer®

Access Our Latest Research

Corbin Advisors Releases Q3’24 Inside The Buy-Side® Earnings Primer®

Survey Finds Notable Sentiment Divergence Resulting in Bull-Bear Barbell; Outright Bearishness at Highest Level in 12 Months with More Downward Guidance Revisions Expected

By providing The Big So What™, we inform, inspire, and influence positive change

Closing the Quarter – Q4'23

Heading into this past earnings season, our Q4’23 Inside The Buy-Side® Earnings Primer® registered a more optimistic tone overall after last quarter’s survey found sentiment increasingly trending neutral. Buttressing this notable shift in mindset was the view that the macro outlook would improve in 2024 amid expectations for a lower interest rate environment. Still, concerns around geopolitics and slowing growth remained.

With Q4’23 earnings season in the books, we “Close the Quarter” with some notable themes:

- Earnings: Better-than-expected fundamental Q4 earnings reports were bolstered by several macro tailwinds, including a resilient consumer, government spending, and the AI investment cycle.

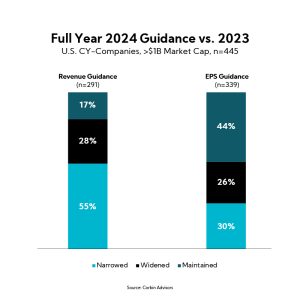

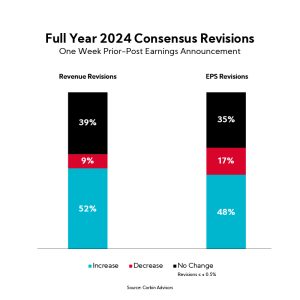

- Guidance Moves and Consensus Shifts: In general, company forecasts are calling for a weaker first-half, followed by strength toward the end of the year. Guidance and executive commentary resulted in relatively few consensus cuts to annual figures, with more analysts opting to boost full year 2024 estimates for both revenue and EPS.

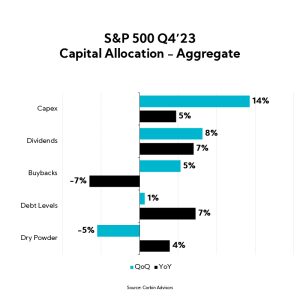

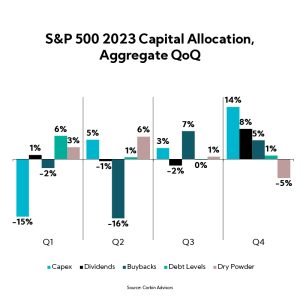

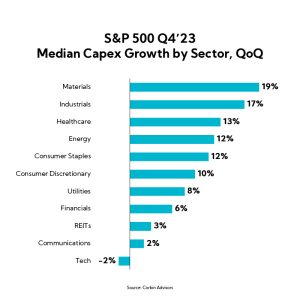

- Capital Allocation: Sequential cash uses indicate double-digit increases in capex and an uptick in deal activity more broadly.

Despite warning signs that have caused concerns in prior economic cycles (for example, an inverted yield curve and declines in certain leading economic indicators), many companies at a minimum seem increasingly less worried, and in some cases, outright more confident based on recent quarterly management commentary.

However, despite the recent market exuberance, there remain percolating undercurrents of caution in executive earnings addresses that still hint at a more measured outlook in the nearer term (under promise and over deliver is alive and well). There also remains mixed views on what the Federal Reserve will do and when, and geopolitical issues without conceivable ends continue to be a thorn in the side of the Fed getting inflation down to its target. And, with the November election on the horizon, companies should brace for heightened volatility and a potential shift in focus, as political developments may sway market sentiment and redirect investor attention.

Corbin Advisors is a strategic consultancy accelerating value realization globally. We engage deeply with our clients to assess, architect, activate, and accelerate value realization, delivering research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset.

Partner with Us

Leverage the experience and expertise of our team.

A strategic consultancy accelerating value realization globally

About Corbin

Advisory Solutions

- Earnings

- Environmental, Social, and Governance (ESG)

- Initial Public Offering (IPO)

- Investor Days

- Investor Presentations

- Investor Relations Advisory

- Investor Relations Immersion

- Investor Targeting & Marketing

- Research as a Service (RaaS)

- Strategic Communications Gap Analysis

- Strategy & Communications

- Voice of Investor® Perception Studies

Subscribe to Inside The Buy-Side®

Access insights in our regularly published research, which captures trends in institutional investor sentiment globally.