Amid “Mixed Bag”, Stable Q3’25 Industrial Performance Expected with Pockets of Strength; Cautious Optimism Continues to Build for a Stronger, More Broad-based Growth Setup in 2026

Access Our Latest Research

Q3’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Positive Investor Sentiment Continues to Build as Heightened Expectations for Higher Growth Contend with Anticipated Tariff Turbulence

By providing The Big So What®, we inform, inspire, and influence positive change

This Week in Earnings – Q4'23

Materials in our Sector Beat

This week, we’re covering Materials in our Sector Beat — a must read if you’re interested in gleaning insights into broader economic indications for 2024.

At a fundamental level, performances out of the Materials sector have garnered the unfortunate distinction as being the only sector outside of Energy who’s blended (reported and estimated) S&P 500 results have culminated in negative YoY top- and bottom-line growth in Q4’23 (-18.9% and -5.7%, respectively). And has been the case across many companies this earnings season, 2024 is being characterized as a “transition year” for much of the sector, but not without its glimmers of upside potential.

While executive commentary has stopped short of characterizing the broad-based slowdown in inventory destocking as a “volume recovery”, early indications through January suggest there are reasons to be optimistic that demand will normalize as the year progresses. Indeed, many outlooks are baking in an uptick in dynamics through the back half of 2024. Focus has thus shifted toward boosting volumes and generating operating leverage, particularly as the price lever is becoming more difficult to pull in the face of weak demand. As a result, productivity enhancements aimed at bolstering profitability, including cost and facility restructuring, are a clear and common theme throughout calls.

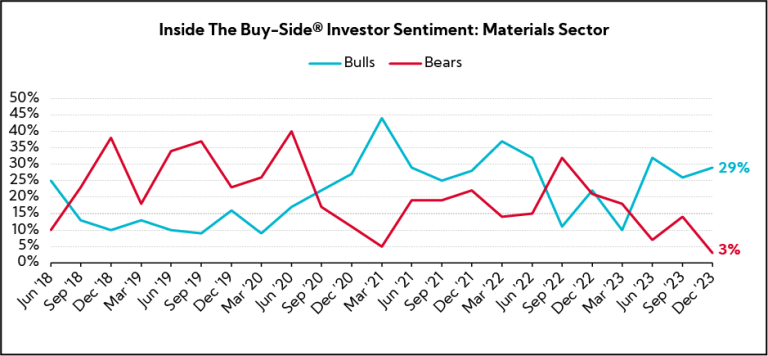

The Big So What™? The combined level of bullish and bearish sentiment registered toward Materials was the lowest among all surveyed sectors in our latest our latest Inside The Buy-Side® Earnings Primer® published on January 11. While there remains an overall lack of conviction in the sector, outright bearishness for these names has also receded to five-year lows.

Key Themes from Our Analysis

- Outlook: 2024 Anticipated to be a “Transition Year”, with Demand Improvements Expected to be Largely Back-Half Weighted

- Inventory: Balancing Optimism with Caution, Executives Taper Industry Characterizations of a Recovery, but Note Destocking is “Largely Behind Us”

- Growth: After a Dismal 2023 and Abundant Destocking, Executives Speak to Signs of Reemergent Pockets of Volume

- Cost Cutting & Restructuring: To Backfill Profitability amid Pricing, Executives Tout Productivity Enhancements

- Inflation: While Many Acknowledge Significant Moderation, Executives Point to Persistent Input Cost Inflation, Including Labor and Energy, with Recent U.S. CPI Data Continuing to Cloud the Picture

- Supply Chain Recalibration: Reshoring and Nearshoring Drive Manufacturing Trends with a Focus on Mexico: “This is Actually Happening”

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.