Amid “Mixed Bag”, Stable Q3’25 Industrial Performance Expected with Pockets of Strength; Cautious Optimism Continues to Build for a Stronger, More Broad-based Growth Setup in 2026

Access Our Latest Research

Q3’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Positive Investor Sentiment Continues to Build as Heightened Expectations for Higher Growth Contend with Anticipated Tariff Turbulence

By providing The Big So What®, we inform, inspire, and influence positive change

This Week in Earnings

Materials in our Sector Beat

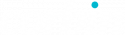

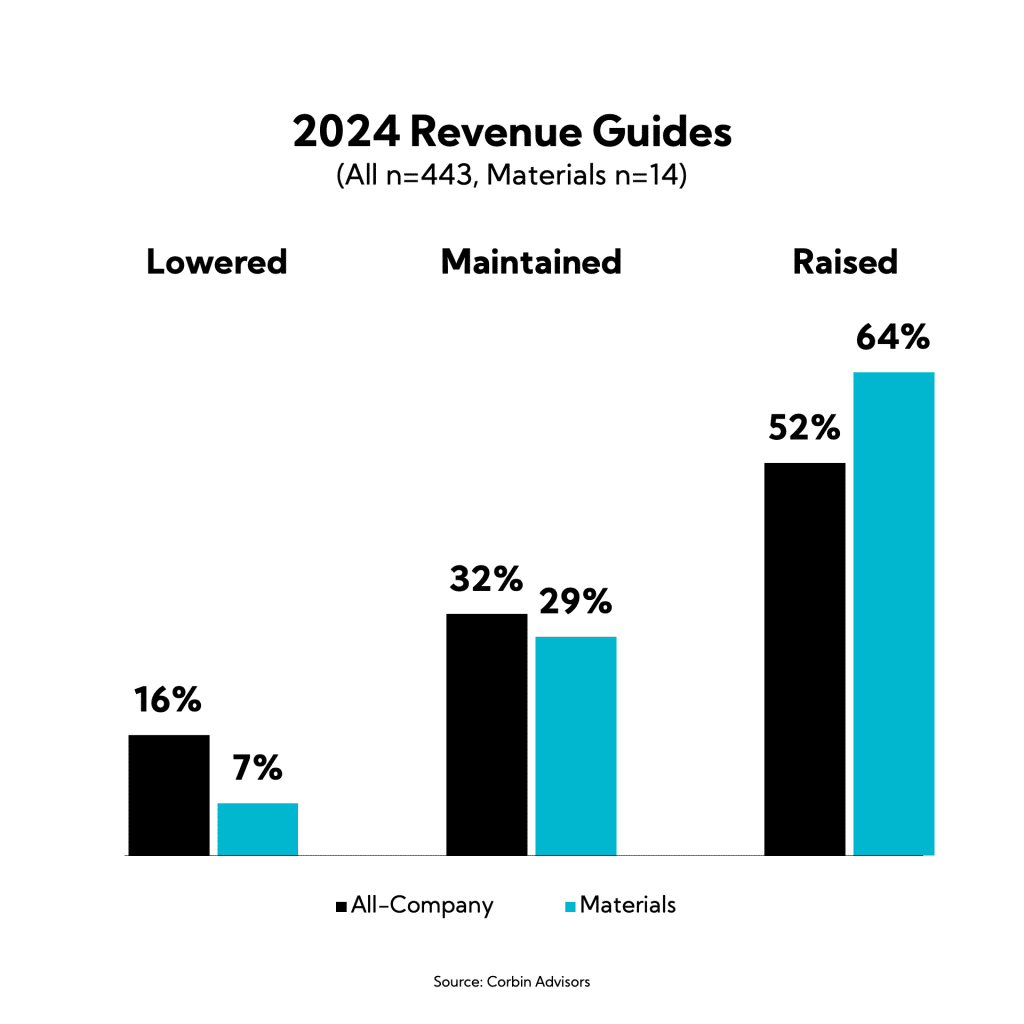

An examination of Materials sector earnings announcements this quarter finds an improving executive tone. “Variable” is the defining word this quarter. Its frequent appearance in prepared remarks and Q&A underscores an industry still in flux, but showing early signs of stabilization and more optimism relative to previously cautious views. This pivot is evident not only in executive commentary, but also in consensus estimates for the remainder of the year.

While Materials sector YoY blended earnings growth of -20.2% is among the worst performances in the S&P 500 through Q1, surpassed only by Energy (-24.1%) and Healthcare (-24.0%) results, signs of green shoots, specifically volume stabilization, is underpinning consensus estimates of continued growth as the year progresses.

Executives continue to collectively express more optimism about the latter half of 2024 as pockets of restocking begin to emerge. Despite macroeconomic variability across markets and regions, many companies are anticipating conditions to be buoyed by innovation and new product demand, and secular themes in certain sub-industries, such as aerospace, electric vehicles, and infrastructure — all of which are expected to grow faster than the general economy. Still, allegations of import dumping, pricing pressure, and largely improved input costs that are showing signs of reigniting serve as continued headwinds to a sector that has been beleaguered since the first signs of demand deceleration emerged in Q2’22.

Key Themes:

- Macro Outlook: Timing of Improving Conditions Remains “Variable” Depending on the End Market, though Many Across the Sector Continue to Express More Optimism toward the Back-Half of 2024

- Demand and Volume Trends: Near-term Weakness Noted for Many in North America, though “Varying Degrees” of Demand Pickup Observed; Inventory Sees “Pockets of Restocking” for Some and “Destocking Coming to an End” for Others

- Expense Management and Productivity: Amid Continued Constrained Volume, Expense Management and Productivity Initiatives, Including Headcount and Variable Pay Reductions, Remain Intact; Several Point to Future Operating Leverage Amid Eventual Normalized Production Rates

- Inflation: Largely Stabilized and Lower Raws…For Now

- Unfair Trade: Executives Call for Action against Unfair Trade Practices (AKA “Dumping”) Amid Rising Concerns Over Low-Cost Imports from Asia

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.