Survey Finds Investor Headiness for Growth Persists with Expectations Intact for 2026 Expansion; Frothy Valuations, Policy Impact, Geopolitics, and AI Bubble Curb Enthusiasm Somewhat

Access Our Latest Research

Q3’25 Inside The Buy-Side® Industrial Sentiment Survey®

Amid “Mixed Bag”, Stable Q3’25 Industrial Performance Expected with Pockets of Strength; Cautious Optimism Continues to Build for a Stronger, More Broad-based Growth Setup in 2026

By providing The Big So What®, we inform, inspire, and influence positive change

Closing the Quarter: Q2'24

Heading into earnings season, our Q2’24 Inside The Buy-Side® Earnings Primer® survey, published July 11, registered one of the largest pullbacks in sentiment in the last five years — from increasingly bullish sentiment over the prior two quarters to squarely neutral — though outright bearishness remained at bay. Despite increased concerns over the consumer, the political landscape, and the economy, surveyed financial professionals largely expected Q2’24 results to be in line with both last quarter and relative to consensus, and annual guides to be maintained.

With Q2’24 earnings — a season with a lot of hair and teeth — in the books, we “Close the Quarter” with some notable themes:

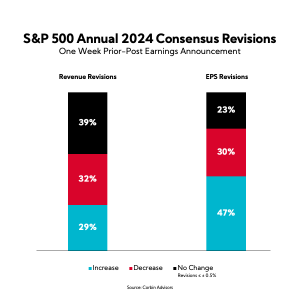

- Earnings Performance: Q2 earnings prints surprised to the upside, though top-line beats settled well below the 5-year average

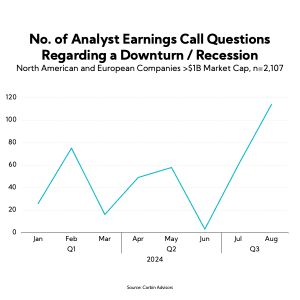

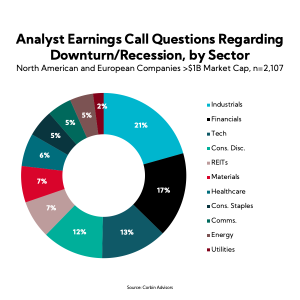

- Outlook: Executive outlooks heavily influenced by the macro, namely election uncertainty, the Fed, and geopolitics; the “second half” growth narrative has faded for most, and recessionary / downturn questions spiked

- The Consumer: Consumer pressures have “deepened and broadened”; “consumer weakness” mentions jump on earnings calls

- Guidance Moves and Consensus Shifts: While more companies raised EPS guidance and most sectors saw more analysts revising EPS higher, top-line expectations are more mixed QoQ, with growth midpoints decreasing, on average

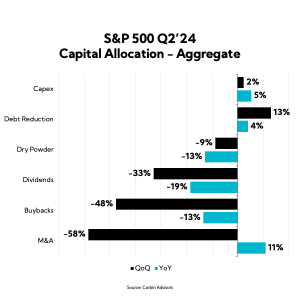

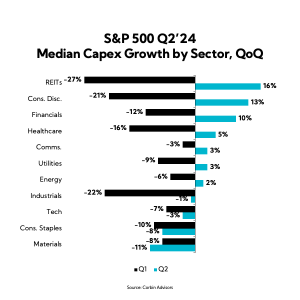

- Capital Allocation: QoQ cash deployment trends reveal early signs of capex momentum and modest M&A value and volume improvement; aggregate dividend, dry powder, and buyback levels shrink

As we wrap up our coverage of Q2’24 earnings season, it’s clear that commentary remains heavily influenced by macro factors like the election, the Fed’s actions, geopolitical risks, and shifting consumer behavior. While we “don’t want to own the macro,” as market volatility fuels fresh recession concerns, we do want to focus on what we can control in our messaging. As warranted, dusting off (or creating) the Downturn Playbook and providing Scenario Analyses that frame different scenarios and the actions your company will take are powerful communication tools in uncertain economic times like these. Indeed, they serve to provide guardrails (inherently, the Street is risk averse and often over rotates on the ‘worst case’) and calm anxiety, as information is knowledge.

Rather than attempting to predict or manage external forces, the most effective narratives emphasize what your company directly controls — customer focus and commitment, operational efficiency, strategic investments. Looking ahead, there is pent-up demand and companies should be preparing for the time when the pressure is released — an interest rate cut, an election outcome — and positioning their organization to be at the ready to capture that opportunity.

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.