Cautiously Optimistic Investor Sentiment Prevails as Intact Secular Growth Trends and Constructive Views on Order Rates Support Firm Setup in 2026; Policy Impact Serves as a Governor

Access Our Latest Research

Q4’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Investor Headiness for Growth Persists with Expectations Intact for 2026 Expansion; Frothy Valuations, Policy Impact, Geopolitics, and AI Bubble Curb Enthusiasm Somewhat

By providing The Big So What®, we inform, inspire, and influence positive change

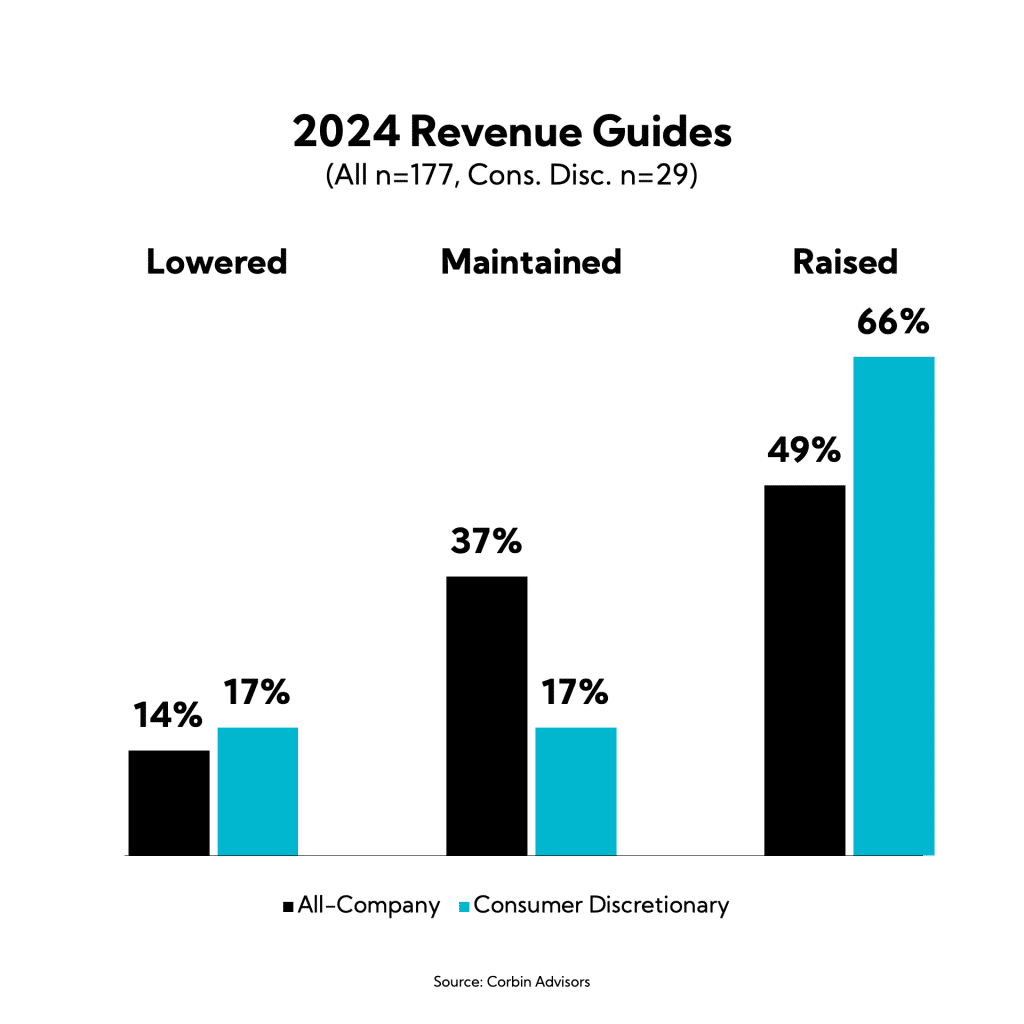

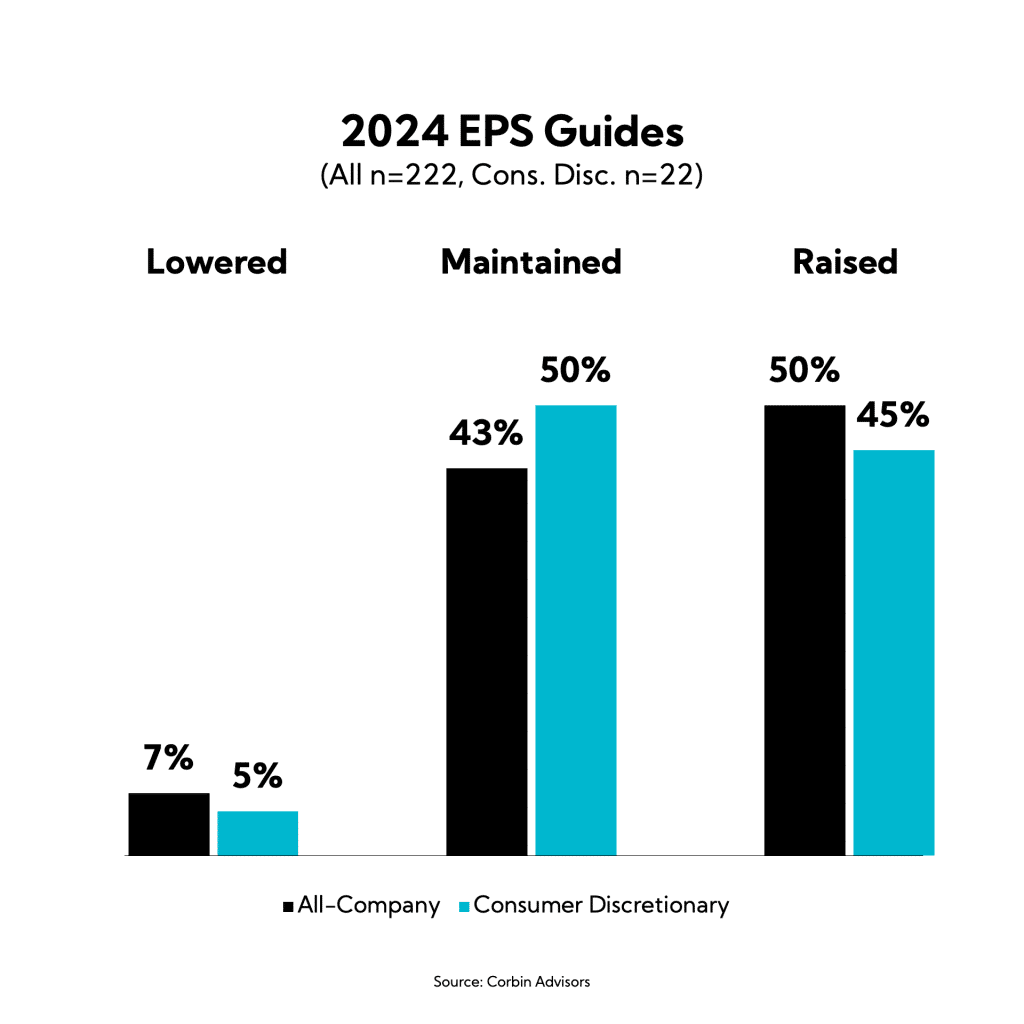

This Week in Earnings – Q1'24

Consumer Discretionary in our Sector Beat

Many observed a cautious consumer environment through the first three months of the year, leading to subdued traffic, sales, and a more competitive landscape overall, especially in regions like China where recovery has been slower than expected. Executives are observing “continued softness in consumer discretionary spend,” and a lower-income shopper that is being ever more discerning with their wallet.

Amid a softer demand environment, companies have been reluctant to pass on pricing increases, focusing instead on productivity and cost-saving measures — including layoffs — to protect profits. To that end, many are taking a conservative approach to inventory to mitigate risk among fluctuating consumer demand.

A consistent theme, labor costs emerged as a significant challenge for many companies. Simultaneously, consumer prices rose more than expected last month and consumer confidence dipped to its lowest point in nearly two years, suggesting that recent wage gains have not sufficed to alleviate lingering impacts of higher inflation.

Key Themes

- Macro Outlook: Executives, Particularly in Restaurants and Retail, Point to Acute Challenges in Store Traffic and Consumer Spending Patterns, Ultimately Culminating in “Conservative” Outlooks; Lodging and Leisure Remain Relative Bright Spots

- Demand: With Softness across Multiple Industries, Retailers Take Conservative Inventory Positions and Manufacturers Realign Production

- Consumer Health: Consumers are “Very Discriminating” with Where They’re Spending Their Remaining Nest Egg Due to the Compounding Effects of Inflation; Many are Focusing on Value and Carefully Managing Discretionary Spend

- Inventory: Companies Have Crossed the Rubicon…Levels Have “Rightsized”

- Margins and Pricing: While Some Executives Highlight Moderating Input Costs, Many Point to Rising Labor and Exhibit Overall Hesitation to Implement Additional Pricing Adjustments; Companies Focus on Productivity, Automation, and Staff Reductions to Maintain Profitability

- China: Remains A Challenging Market, Albeit Improving for Some; Executives Reinforce the “Long Game”

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.