Amid “Mixed Bag”, Stable Q3’25 Industrial Performance Expected with Pockets of Strength; Cautious Optimism Continues to Build for a Stronger, More Broad-based Growth Setup in 2026

Access Our Latest Research

Q3’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Positive Investor Sentiment Continues to Build as Heightened Expectations for Higher Growth Contend with Anticipated Tariff Turbulence

By providing The Big So What®, we inform, inspire, and influence positive change

Closing the Quarter: Q2'25

As we wrap up our coverage of Q2’25 earnings season, it’s clear that companies have largely been able to deliver solid results despite ongoing macro uncertainty, in part driven by consensus estimates having been meaningfully lowered following last quarter. While mega-caps and companies benefiting from secular tailwinds, such as AI, defense, and selected infrastructure buildout, have been driving strong earnings growth, companies across industries continue to face a dynamic macro environment punctuated by shifting trade policy, uneven order trends, ramping costs, and apprehension that higher prices could weigh on demand in the second half.

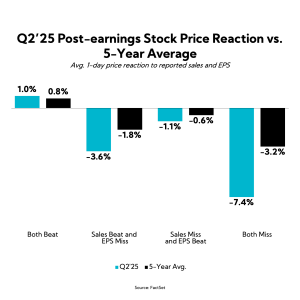

Meanwhile, valuations have become increasingly stretched with major indices at all-time highs, even as the broader economy is holding up but not firing on all cylinders, with a cooling labor market and an increasingly price-conscious consumer. In this context, we saw several instances of stocks selling off on signs of slowing top-line growth despite solid Q2 bottom-line performance. It’s too early to call a definitive shift in investor preference toward growth over margins, but we’ll be watching this closely into Q3.

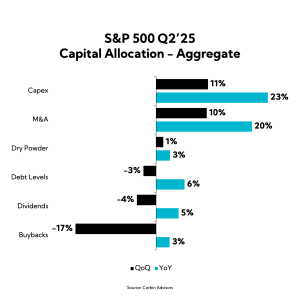

And on the topic of growth…what gets the global economy humming is spending, not cutting. The general across-the-board increases in capex this quarter and year-over-year is notable as is the hunger for expansion from the investment community. Companies prepared to capture the inflection by shifting with clarity from expense management to investment stand to pull ahead.

With Q2’25 earnings largely in the books, we “Close the Quarter” with some notable themes:

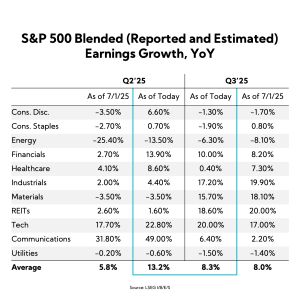

- Q2 Earnings Performance: Big Surprises to the Upside (Relative to Reset Consensus), with EPS and Revenue Growth Above 5-Year Averages; Steady, but Slower Growth Projected Ahead

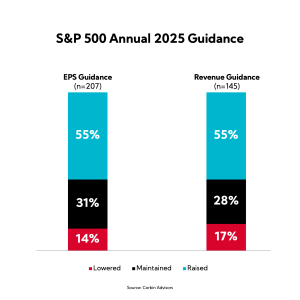

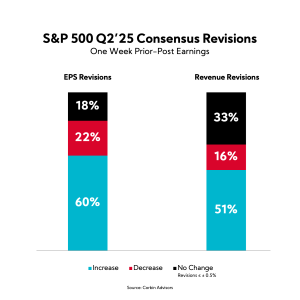

- Guidance Moves and Consensus Shifts: After a Solid 1H, a Slight Majority Raise 2025 Guides for Both Revenue and EPS; Tech, Healthcare, Communications, Industrials, and Energy See the Most Broad-based Upward Revisions across Revenue and EPS Consensus Estimates, While Materials Stands Out as the Only Sector with More Decreases than Increases for Both Metrics

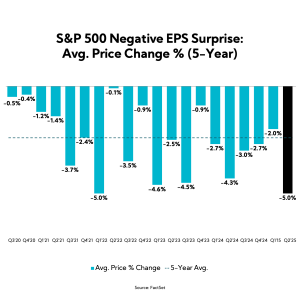

- Stock Price Reactions: Misses Punished More Than Historically, Including Some That Delivered on the Bottom-line but Fell Short on Top-Line

- Tariffs & Trade Policy: Mitigation and Lower‑than‑Feared Tariffs Limit Q2 Impact; Execs Note Margin and Demand Headwinds Set to Build in 2H

- OBBBA: Analysts Probe for Expected Impacts; Execs Cite Bonus Depreciation and R&D Expensing as Key Tailwinds, See Potential to Spur Investment; Full Impacts Still Being Assessed

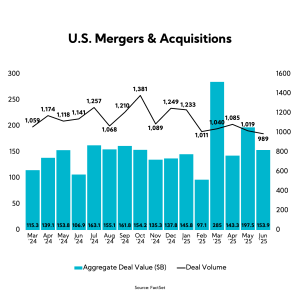

- Capital Allocation: Cash Deployment Trends Reveal a Shift toward Capex and M&A in Q2 as Buybacks and Dividends see Declines QoQ; All Categories Higher YoY

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.