Cautiously Optimistic Investor Sentiment Prevails as Intact Secular Growth Trends and Constructive Views on Order Rates Support Firm Setup in 2026; Policy Impact Serves as a Governor

Access Our Latest Research

Q4’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Investor Headiness for Growth Persists with Expectations Intact for 2026 Expansion; Frothy Valuations, Policy Impact, Geopolitics, and AI Bubble Curb Enthusiasm Somewhat

By providing The Big So What®, we inform, inspire, and influence positive change

Closing the Quarter: Q1'25

Heading into earnings season, our Q1’25 Inside The Buy-Side® Earnings Primer® survey, published April 10, revealed a sharp reversal in optimism with both investor sentiment and perceived executive tone exhibiting 40%+ pullbacks QoQ, the largest on record, driven by tariff concerns, policy uncertainty, and deteriorating growth forecasts. To that end, the survey found nearly two-thirds expected 2025 U.S. GDP to come in below 2024 levels, with nearly 6 in 10 bracing for a recession, a sharp increase from 22% in the prior quarter. Tariffs, along with growth and demand trends, were identified as the primary focus areas for upcoming earnings calls, followed by margins.

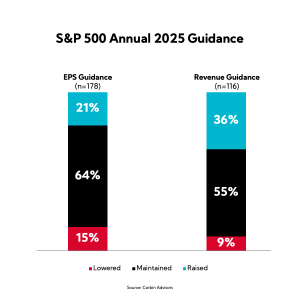

Regarding guidance expectations, while more anticipated companies to maintain 2025 outlooks prior to the April 2 reciprocal tariff announcement, our post-announcement pulse poll showed 57% expecting a meaningful downgrade to earnings forecasts for most sectors, while 77% encouraged companies to include the tariff impacts in guidance updates.

With Q1’25 earnings largely in the books, we “Close the Quarter” with some notable themes:

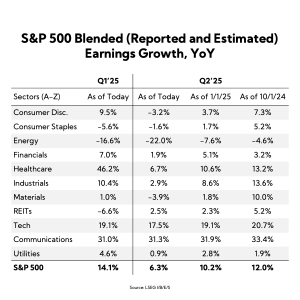

- Earnings Performance: Q1 Earnings Prints Surprised to the Upside, But with Marked Deceleration Forecasted Ahead; Revenue Beats Settled Below the 5-Year Average

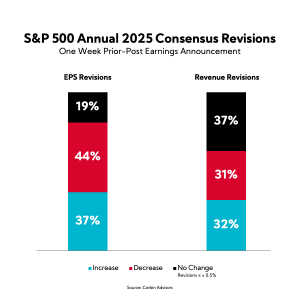

- Guidance Moves and Consensus Shifts: Companies Take a Conservative Stance with a Majority Maintaining 2025 Guides for Revenue and EPS; Tech, Communications, and Healthcare Stand Out as the Only Sectors to See More Increases than Decreases Across Revenue and EPS Consensus Estimates, While 6 of 11 Sectors Saw More Decreases for Both Metrics

- Tariffs & Trade Policy: “Tariffs” and “Uncertainty” Dominate Earnings Calls as Companies Contend with Trade Policy Shocks in the Wake of President Trump’s April Tariff Announcements

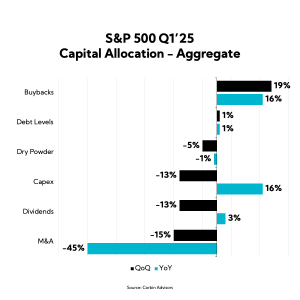

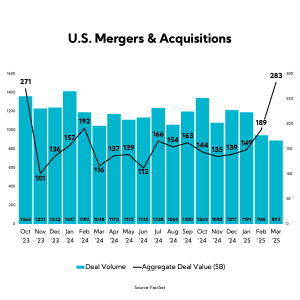

- Capital Allocation: Cash Deployment Trends Reveal a Shift Toward Buybacks in Q1 as Capex, Dividends, and M&A see Notable Declines QoQ

As we wrap up one of the more extraordinary earnings seasons in years, it’s clear that companies were largely able to deliver solid earnings results during Q1 owing in part to pull-forward buying behavior ahead of tariff impact, though challenging dynamics existed for certain sectors, most notably Materials and Energy. The focus this quarter was squarely on forward guidance, with heightened uncertainty and rapidly shifting trade policies clouding the road ahead. While executives have broadly highlighted proactive mitigation actions and projected confidence in their ability to manage the impact from tariffs, the months ahead will be telling.

While the U.S.-China tariff pause may have removed the tail risk of an all-out global trade war, trade talks remain in flux, and tariff rates are not going to zero. Against this backdrop, companies can build credibility with the Street globally by effectively managing through these historically turbulent times, making tough decisions proactively, while also preparing for an eventual capex super cycle. But it’s execution x communication that carries water with investors who are drinking from a fire hydrant and looking for compelling, easy-to-understand investment opportunities.

Indeed, it’s a stock picker’s market and by taking control of your narrative and communicating the strategies you are implementing to navigate current challenges and position the company for long-term strength — always with transparency and candor — you can capture investor mindshare and wallet share, regardless of the macro environment. Investors gotta invest and what they don’t know, they won’t buy.

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.