Cautiously Optimistic Investor Sentiment Prevails as Intact Secular Growth Trends and Constructive Views on Order Rates Support Firm Setup in 2026; Policy Impact Serves as a Governor

Access Our Latest Research

Q4’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Investor Headiness for Growth Persists with Expectations Intact for 2026 Expansion; Frothy Valuations, Policy Impact, Geopolitics, and AI Bubble Curb Enthusiasm Somewhat

By providing The Big So What®, we inform, inspire, and influence positive change

What can we learn from 2023 guidance practices as we enter 2024?

To garner insights into the latest trends, we analyzed the guidance practices of the S&P 500.

Key Findings:

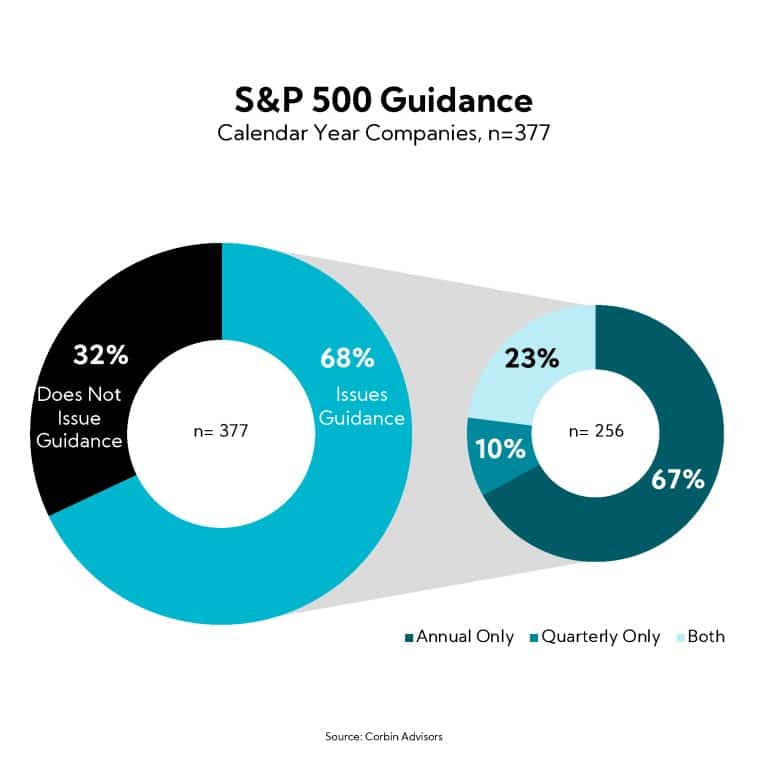

- Practice: Among the S&P 500, a substantial 68% of companies provide some form of quantitative guidance, encompassing Revenue, EPS, EBITDA, Capex, and/or FCF.

- Cadence: Notably, two-thirds of this cohort issue annual guidance only, while 10% and 23% provide quarterly only or both, respectively.

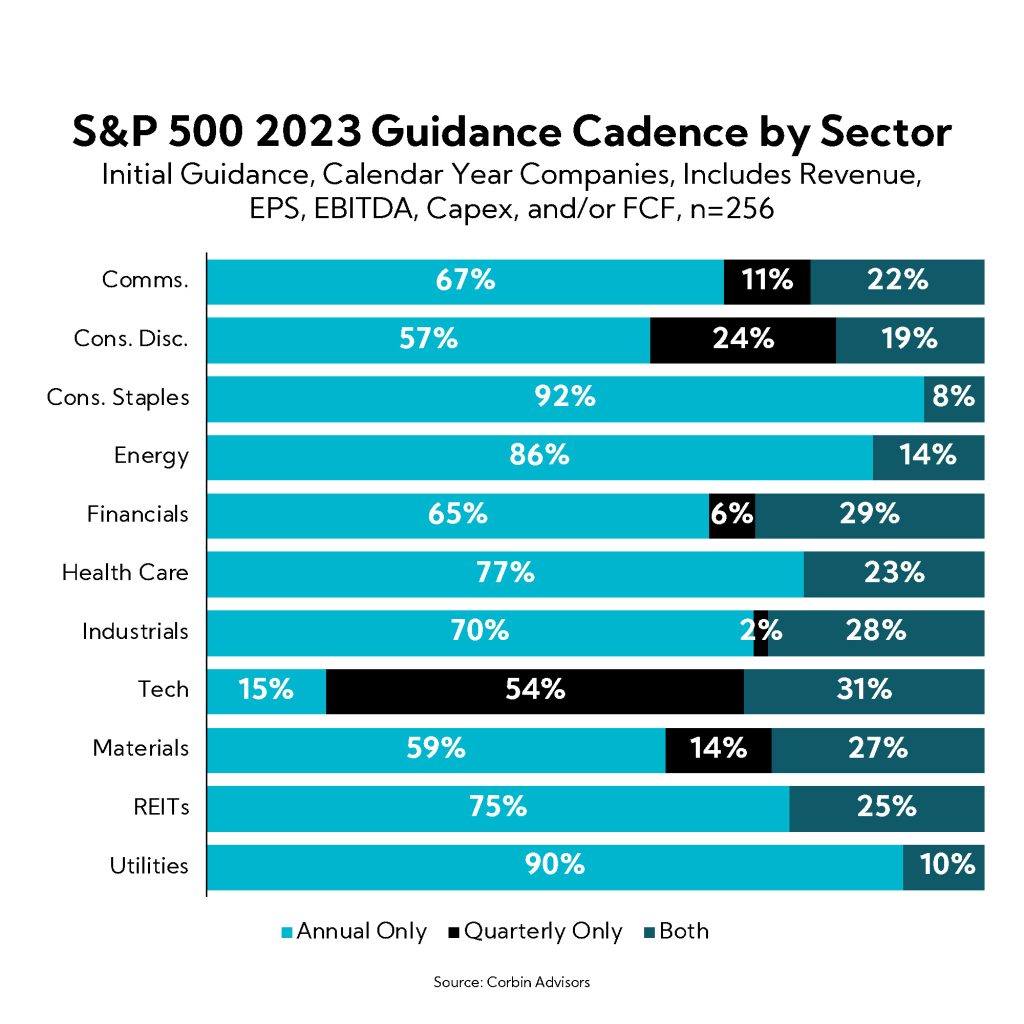

- Leading Metrics: Revenue and EPS are the leading guidance metrics provided on both an annual and quarterly basis, while Capex and FCF are the most commonly issued on an annual-only basis. The sectors with the most quarterly-only guidance issuers are Tech and Consumer Discretionary.

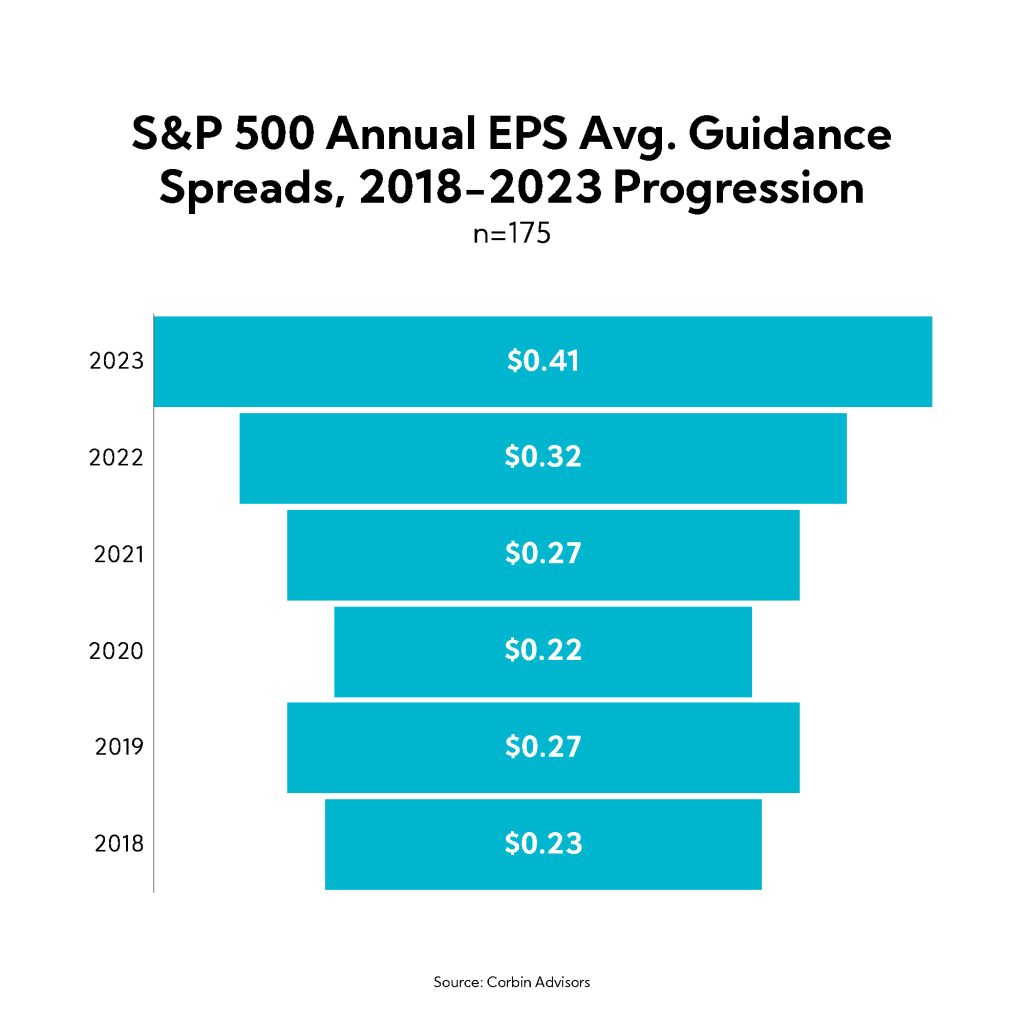

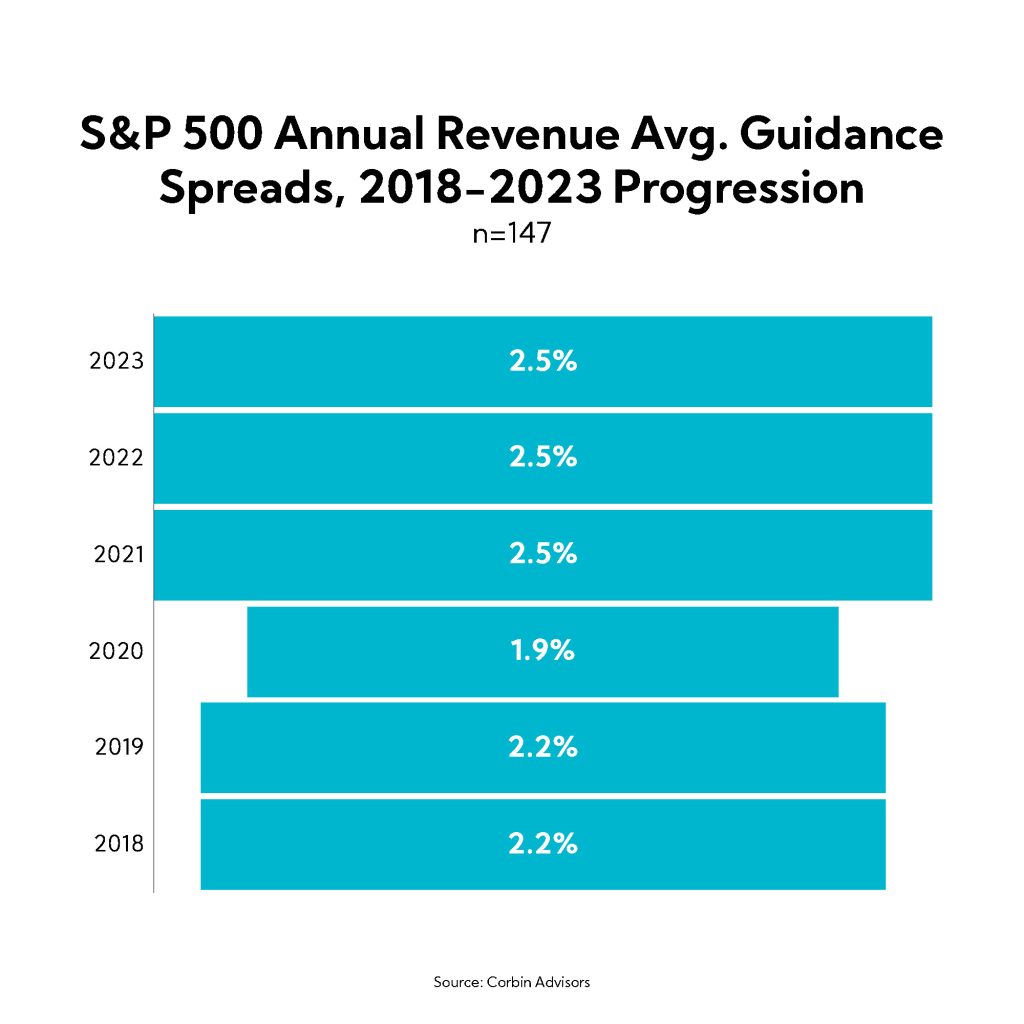

- Evolution of Guidance Spreads: When looking at pre- and post-pandemic guidance setting (2018 – 2023), we confirm that spreads are widening, largely to account for increased uncertainty and smarter expectations management.

- EPS Guidance: The average annual EPS guidance spread has widened in recent years, escalating from $0.23 in 2018 to a substantial $0.41 in 2023.

- Revenue Guidance: Average top-line spreads, while also increasing over the same 5-year timeframe, widened 0.3% and have held steady over the past three years.

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.