Research & Insights

Thought Leaders at the Forefront of Best Practice

For over a decade, we have surveyed global investors on the equity markets, world economy, and business climate. At the start of every earnings season, we publish our leading-edge Earnings Primer® and Industrial Sentiment Survey®, which capture real-time investor sentiment and trends. At the cross-section of investors and corporates, we are thought leaders and regularly publish research-based insights and best practices.

Corbin Analytics

Interviews with

Institutional Investors

Companies

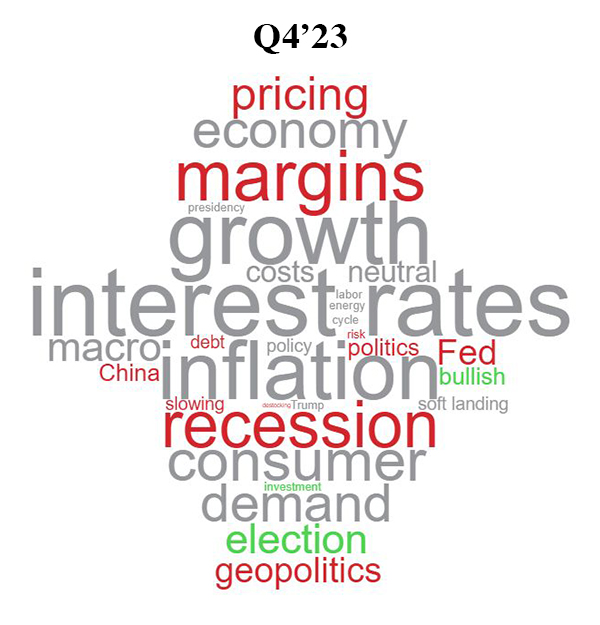

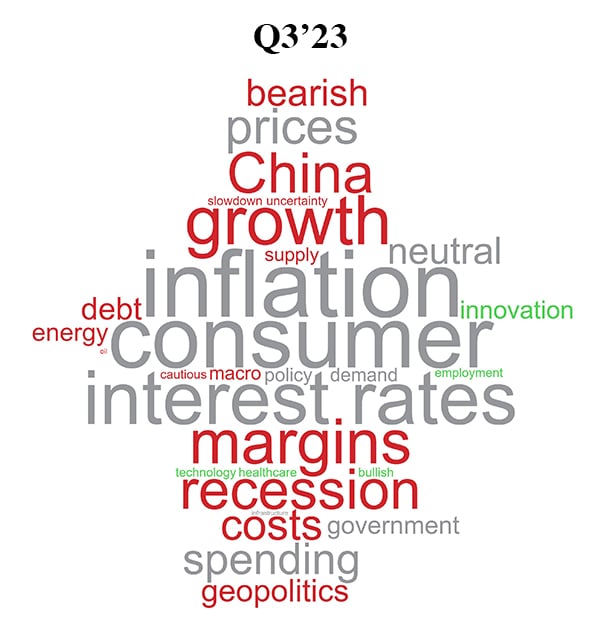

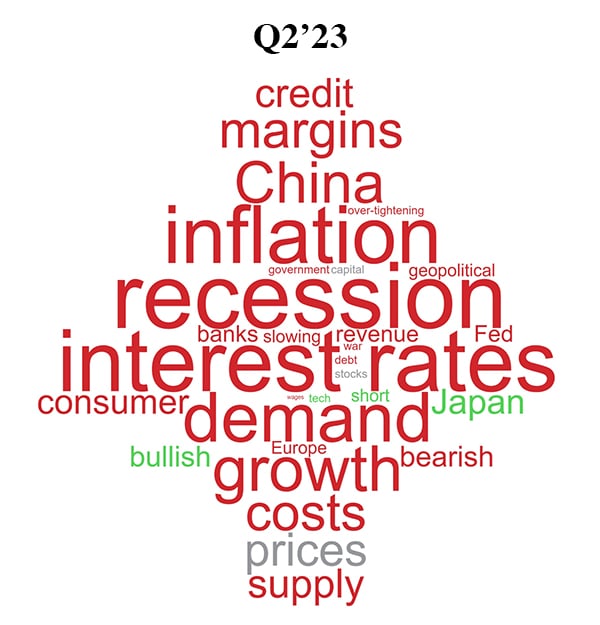

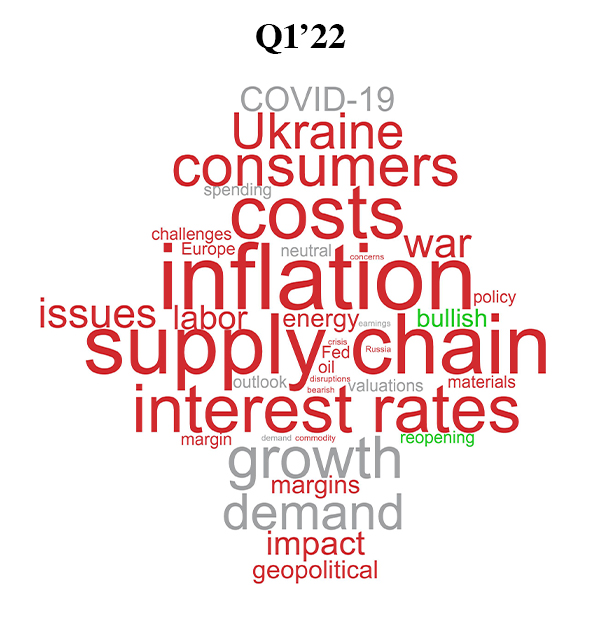

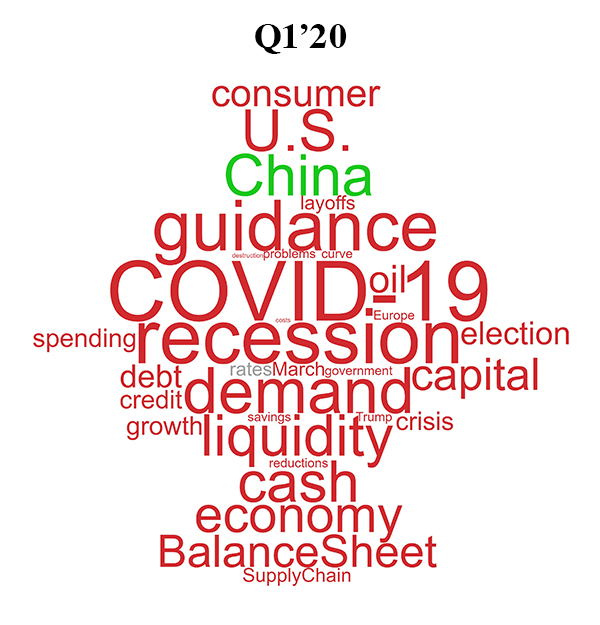

“With earnings season about to commence, our survey finds increasing optimism amongst the investment community amid the growing belief that we bottomed in 2023 and that, despite sticky inflation and a higher-for-longer interest rate environment, 2024 will offer year-over-year improvement. Supporting expanding positive sentiment is increased executive confidence, a U.S. election year, and durable secular growth trends, including continued government spending and the proliferation of AI. While uncertainty remains, it, along with recessionary concerns continue to moderate. Still, dialogue around the prospect of reaccelerating inflation, prolonged geopolitical conflict, and a dynamic macro environment is keeping exuberance in check. While those expecting worsening economic conditions in the U.S. has pulled back to its lowest level in over two years, 2024 GDP expectations moderated QoQ. As the market recalibrates from the hotter-than-expected CPI prints and an elusive rate cut schedule in 2024, leading topics for executives to address on upcoming earnings calls include profitability and expense management, demand, and, new this quarter, artificial intelligence.”

Q1’24 Earnings Primer®

Rebecca Corbin, Founder and CEO

Heading into Earnings Season, Optimism Tracks Higher as Investors Cast Off Recessionary Concerns, Adapt to Higher-for-Longer, and Embrace AI...Margin Focus Gets a Shot in the Arm

Industrial Investor Optimism Continues to Rise as Expectations for Broad-Based Weakness are Replaced with Anticipation of an Improving Landscape Amid Inventory Normalization and Orders Green Shoots

Subscribe to Inside The Buy-Side®

Access insights in our regularly published research, which captures trends in institutional investor sentiment globally.