Cautiously Optimistic Investor Sentiment Prevails as Intact Secular Growth Trends and Constructive Views on Order Rates Support Firm Setup in 2026; Policy Impact Serves as a Governor

Access Our Latest Research

Q4’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Investor Headiness for Growth Persists with Expectations Intact for 2026 Expansion; Frothy Valuations, Policy Impact, Geopolitics, and AI Bubble Curb Enthusiasm Somewhat

By providing The Big So What®, we inform, inspire, and influence positive change

Closing the Quarter: Q3'24

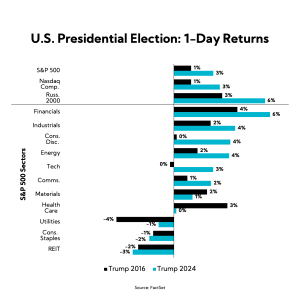

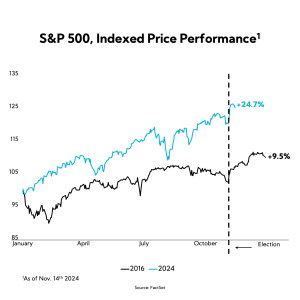

Heading into earnings season, our Q3’24 Inside The Buy-Side® Earnings Primer® survey, published October 10, registered a notable divergence in sentiment resulting in a bull-bear barbell, with fewer investors expecting earnings results to be In Line with consensus, while those anticipating beats and misses both increased notably QoQ. Adding to the already complicated macro landscape, the November election in the U.S. weighed heavily on the minds of investors coming into reporting season. Indeed, over half of respondents cited U.S. politics and election uncertainty as their leading concern, leapfrogging geopolitics. Worries about consumer health remained prevalent, while unemployment and stretched valuations emerged as watchouts. That said, amid interest rate cuts, AI-driven demand, and expectations for “varied” earnings prints, a solid majority reported being Net Buyers or Rotating, with mid-caps seen as the most compelling investment opportunity of all the sizes. Finally, investors were confident that a Trump win would support equity market gains.

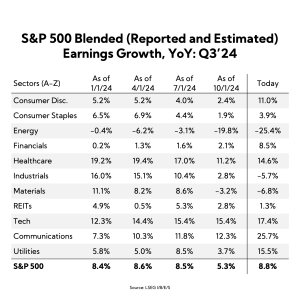

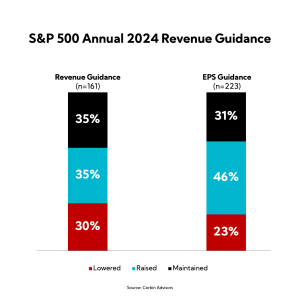

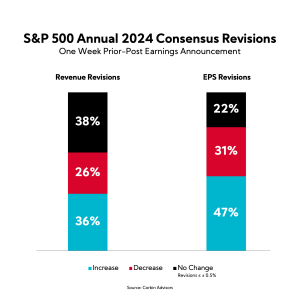

With Q3’24 earnings in the books, we “Close the Quarter” with some notable themes:

- Earnings Performance: Q3 earnings prints surprised to the upside, though top-line beats settled well below the 5-year average

- Guidance Moves and Consensus Shifts: Slightly fewer companies raised eps guidance QoQ while upward analyst revisions outweigh decreases; top-line expectations are mixed, with growth midpoints increasing, on average

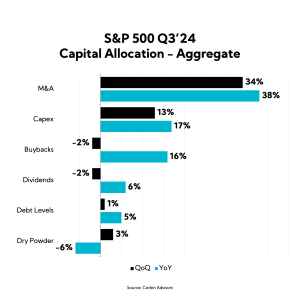

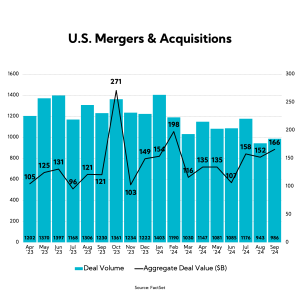

- Capital Allocation: QoQ cash deployment trends reveal a notable M&A pick-up alongside positive capex momentum; dividend and buyback levels dipped QoQ, while dry powder ticked up but remained below year-ago levels

- U.S. Election Impact: While a trump win removed near-term election uncertainty, unknowns abound as focus shifts to policy ramifications

- Activism on the Rise: Q3 saw its share of high-profile activist campaigns as overall activity remains elevated, with Q4 momentum continuing

As we wrap up our coverage of Q3’24 earnings season, it’s clear that macro uncertainty remains top of mind with commentary heavily influenced by the U.S. election, questions around the path of Fed rate cuts, and heightened geopolitical turmoil. While we now have the election behind us, it will take time to gain clarity around what policy changes will be enacted once Trump enters the White House at the end of January.

At the same time, as we observed throughout the quarter, while the U.S. economy has proven resilient by most measures, manufacturing activity remains in the doldrums and many sectors continue to navigate a challenging demand environment globally.

While the timing of a demand inflection is anyone’s guess, you can bolster investor confidence by clearly articulating steps taken to navigate the current backdrop and position for an eventual turn. As we have said for years now, “don’t own the macro” and “control what you can control”.

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.