This Week in Earnings – Q2'25

Consumer Discretionary Sector Beat

Our thought leadership this week addresses:

- Key Events

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Consumer Discretionary in The Sector Beat

Key Events

Trade/Tariffs

- President Trump signed an executive order Thursday that modified “reciprocal” tariffs on dozens of countries, with updated duties ranging from 10% to 41%. A baseline tariff rate of 10% remained for most countries not on the list despite Trump previously suggesting a new floor rate of 15%. Goods considered to have been transshipped to avoid applicable duties will be subject to an additional 40% tariff, according to the White House. Trump also raised the tariff rate for Canada to 35% from 25%, though USMCA-compliant goods will remain exempt. (Source: CNBC, Bloomberg)

- President Trump reached a trade agreement with the European Union and said the U.S. would set a baseline tariff of 15% for European goods, including automobiles. He said the EU had agreed as part of the deal to buy $750 billion of energy products from the U.S. and invest an additional $600 billion in the U.S. (Source: WSJ)

- Trump said the U.S. and Mexico agreed to extend trade negotiations for 90 days in order to give the neighboring countries time to strike a trade deal. However, Mexico will continue to pay a 25% Fentanyl Tariff, 25% Tariff on Cars, and 50% Tariff on Steel, Aluminum, and Copper. Trump also said that Mexico has “agreed to immediately terminate its Non Tariff Trade Barriers,” without specifying which. (Source: CNBC)

- Trump said the U.S. is still negotiating with India on trade after announcing the U.S. would impose a 25% tariff on goods imported from the country starting on Friday. The 25% tariff, as well as an unspecified penalty announced by Trump in a morning social media post, would potentially strain relations with the world’s most populous democracy. (Source: Reuters)

- U.S. Treasury Secretary Scott Bessent expressed confidence that the U.S. and China are on the way to a trade pact as a key tariff deadline nears, saying “we have the makings of a deal”. Bessent did not provide any details on what a final deal with China would look like. (Source: CNBC)

Monetary Policy

- The Federal Reserve kept its benchmark interest rate in a range of 4.25% to 4.50%, in a move that was widely expected by markets. Rates have been at this level since the December 2024 meeting. Fed Chair Jerome Powell said there has been no decision made on how the central bank will proceed at its September meeting, dashing traders’ hopes for a rate cut then. He also said policymakers must wait and see the effect of tariffs before they proceed. (Source: The Federal Reserve)

- The Bank of Canada maintained its target for the overnight rate at 2.75%, as widely expected. The BoC has been on hold since pausing rate cuts at the April 2025 meeting. The Monetary Policy Report stated while some elements of U.S. trade policy have started to become more concrete in recent weeks, trade negotiations are fluid, threats of new sectoral tariffs continue, and U.S. trade actions remain unpredictable. The report presented three U.S. trade policy scenarios with its forecast — a current tariff baseline, an escalation, and a de-escalation, to capture range of potential outcomes. (Source: Bank of Canada)

Employment

- U.S. nonfarm payrolls rose by 73,000 jobs in July, below the 104,000 expected by economists polled by Reuters. Notably, June and May totals were revised sharply lower, by a combined 258,000, now showing that those months added just 14,000 and 19,000 jobs respectively. The unemployment rate ticked to 4.2% from 4.1%, in line with expectations. The weaker than expected report comes as the latest sign of cooling of the U.S. labor market. (Source: Labor Department)

- U.S. Initial claims for state unemployment benefits rose 1,000 to a seasonally adjusted 218,000 for the week ended July 26. The number of Americans filing new applications for unemployment benefits increased marginally last week, suggesting that the labor market remained stable, though it is taking longer for laid-off workers to find new opportunities. (Source: Labor Department, Reuters)

GDP

- U.S. GDP rose at a seasonally and inflation adjusted 3% annual rate in the second quarter. That is up from a 0.5% contraction in the first quarter. Taken together, the two quarters show an economy that is growing, but more slowly. GDP grew at an average annual rate of 1.2% in the first six months this year, a step down from the 2.5% average pace in 2024. Both quarters this year were heavily influenced by swings in trade as businesses tried to navigate tariff threats and trade deals from the White House. (Source: The Commerce Department)

- The Eurozone economy expanded by 0.1% in the second quarter of 2025 compared to the first, better than expectations of growth to flatline. U.S. tariffs and their impact have been a top concern for European economies so far this year. (Source: Eurostat)

- Canada’s GDP shrank 0.1% in May on a monthly basis, as expected. An advanced estimate showed GDP is likely to have expanded by 0.1% in June, and on an annualized basis it could also post growth of 0.1% for the second quarter. (Source: Reuters)

Consumer Confidence

- The Conference Board’s Consumer Confidence index increased 2.0 points to 97.2 this month. Senior Economist at The Conference Board says, “consumer confidence has stabilized since May, rebounding from April’s plunge, but remains below last year’s heady levels. In July, pessimism about the future receded somewhat, leading to a slight improvement in overall confidence…however, their appraisal of current job availability weakened for the seventh consecutive month, reaching its lowest level since March 2021. Notably, 18.9% of consumers indicated that jobs were hard to get in July, up from 14.5% in January.” (Source: Conference Board)

S&P 500 Earnings Snap

66% of the S&P 500 has reported earnings to date

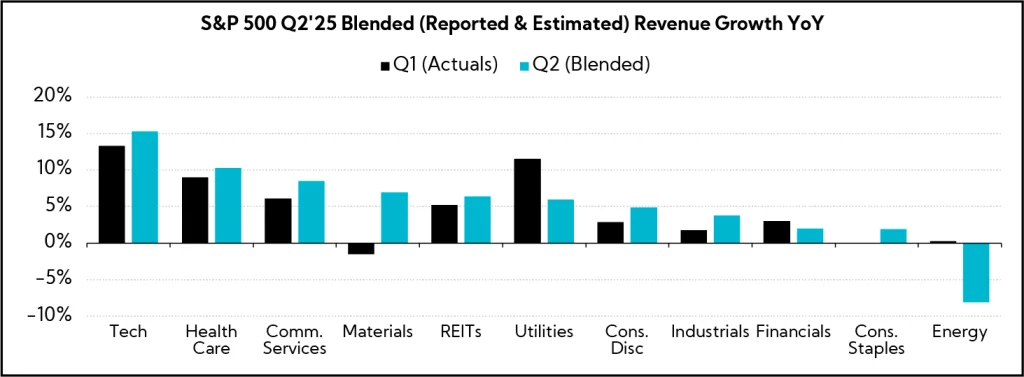

Q2'25 Revenue Performance

- 78% have reported a positive revenue surprise, above both the 1-year average (62%) and the 5-year average (70%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 5.6%

- Companies are reporting revenue 2.6% above consensus estimates, well above the 1-year average (+0.9%) and modestly above the 5-year average (+2.1%)

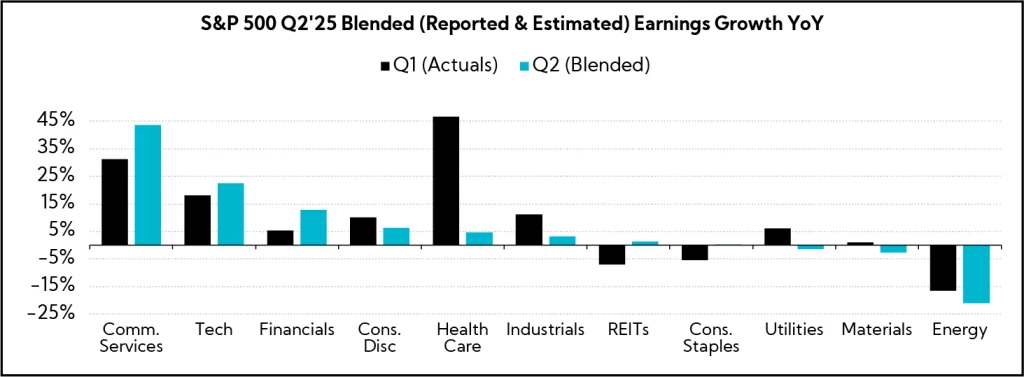

Q2’25 EPS Performance

- 81% have reported a positive EPS surprise, above both the 1-year average (77%) and the 5-year average (78%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 11.2%; excluding the Energy sector, the earnings growth estimate is 13.2%.

- Companies are reporting earnings 8.3% above consensus estimates, above the 1-year average (+6.3%) and below the 5-year average (+9.1%)

The Sector Beat: Consumer Discretionary

Consumer Discretionary Guidance

At the beginning of each quarter, we analyze annual revenue and EPS guidance provided by U.S. Consumer Discretionary companies with market caps greater than $1B that have reported to date. Below are our findings. For comparison purposes, we provide an “All Company” benchmark, which tracks a basket of U.S. companies1 across all sectors that have reported earnings to date (n = 354).2

Guidance Breakdown by Industry

| Industry | Number of Companies |

|---|---|

| Specialty Retail | 8 |

| Automobile Components | 7 |

| Hotels, Restaurants & Leisure | 6 |

| Diversified Consumer Services | 6 |

| Textiles, Apparel & Luxury Goods | 4 |

| Distributors | 3 |

| Household Durables | 3 |

| Leisure Products | 2 |

| Automobiles | 2 |

| Broadline Retail | 1 |

| Total | 42 |

Source: Corbin Advisors

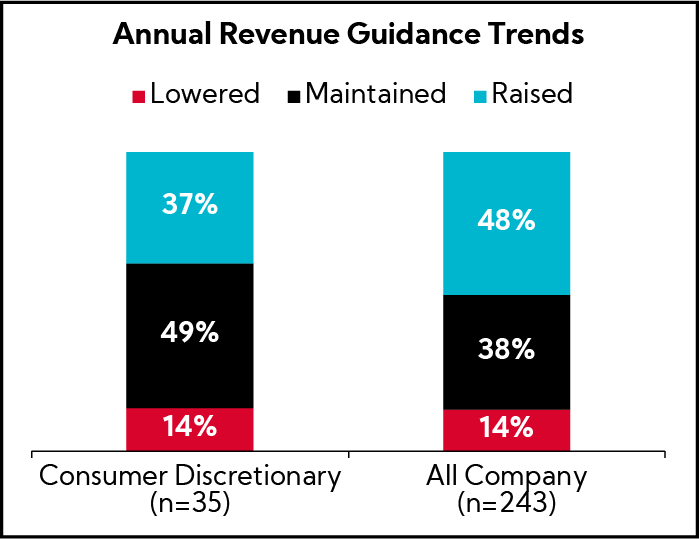

Revenue Guidance

To date, nearly half of Consumer Discretionary companies have Maintained their annual revenue guidance, above the All-Company benchmark. However, fewer Consumer Discretionary companies have Raised guidance.

- Companies that Lowered guidance (n = 5)

- Average midpoint of 1.0% growth versus 1.7% last quarter

- Average spread decreased by 20 bps to 2.2%

- Companies that Maintained guidance (n = 17)

- Average midpoint of 4.2% growth

- Average spread of 4%

- Companies that Raised guidance (n = 13)

- All but three companies raised the top and bottom of the original range; PHINIA and Udemy raised the bottom, but maintained the top, while Garret Motion raised the top but maintained the bottom

- Average midpoint of 7% growth versus 3.1% last quarter

- Average spread decreased by 30 bps to 3.4%

- Overall midpoints assume 4.6% annual growth, on average, the same as last quarter

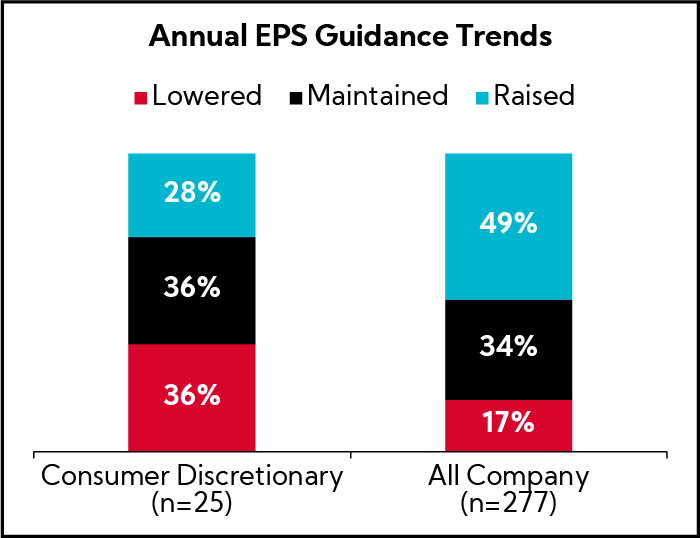

EPS Guidance

While 36% of Consumer Discretionary companies have Maintained annual EPS guidance, an equal share, 36%, have Lowered, more than double the rate for the broader All-Company benchmark. Meanwhile, 28% of Consumer Discretionary companies have Raised EPS guidance, well below the 49% observed across all companies.

- Companies that Lowered guidance (n = 9)

- All but one company lowered the top and bottom of the original range; Academy Sports and Outdoors lowered the bottom, but raised the top

- Excluding WHR whose spread increased from $0.00 to $2.00, the average spread increased from $0.30 to $0.34

- Companies that Maintained guidance (n = 9)

- Average spread of $0.44

- Companies that Raised guidance (n = 7)

- Nearly all companies raised the top and bottom of the range; Royal Caribbean Group and Five Below raised the bottom, but maintained the top

- Average spread decreased from $0.34 to $0.17

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Consumer Discretionary universe to identify key themes.

Overall, management teams strike a more balanced tone relative to last quarter, trading the overtly cautious stance expressed during Q1 for one of “better than previously expected” but “still cautious” coming out of Q2. Persistent macro uncertainty, shifting tariff policy, and subdued consumer sentiment remain front and center, with concerns around margin pressures and demand volatility weighing on outlooks. In addition, tariff-related order disruptions and aggressive pricing from foreign competitors created unique challenges for select companies.

Indeed, while Consumer Discretionary companies are delivering Q2 beats at a healthy clip, our analysis finds the sector lowering full-year EPS guidance at more than double the rate of our All-Company average. Further, while some of those that withdrew annual guides in Q1 have moved to reinstate guidance this quarter, half of the ten companies tracked across the sector thus far have continued to withhold as they await greater clarity on trade policy.

Tariffs continue to dominate Q&A, with executives largely noting impacts in Q2 were less than feared due to early mitigation actions and timeline extensions. Still, execs point to a challenging and fluid environment, with many anticipating rising costs and greater tariff headwinds in the second half. The ability to pass on higher prices without triggering demand destruction is a growing concern, with companies watching closely for signs of consumer fatigue and pushback.

To that end, consumer health remains a nuanced story. While spending has been holding up in aggregate, the “discerning and value-seeking” theme persists with continued talk of deferrals on big ticket purchases. Still, travel and leisure remains a notable bright spot. Globally, trends are mixed, with the U.S. consumer proving more resilient than peers in Europe and China, and select markets in APAC and the Americas showing pockets of strength.

Finally, the recently passed OBBBA tax bill is emerging as a new tailwind, with bonus depreciation and other tax relief measures expected to boost cash flow and investment appetite for some companies. However, most are still assessing the impact, and the flow-through to consumer behavior remains to be seen.

Key Consumer Discretionary Themes

Macro & Outlooks

Cautious Optimism Emerges Despite Challenging Macro Environment and Tepid Consumer Confidence; Some Reinstate FY Guides Pulled in Q1, While Several Continue to Withhold amid Ongoing Tariff Uncertainty

- O’Reilly Automotive ($83.1B, Specialty Retail): “The increase in our guidance range at the top end reflects the potential for incremental benefit we could realize from the effective price management, as we navigate the challenging tariff environment. We have begun to see some incremental benefit filter into our numbers from industry-wide pricing actions spurred by the first round of tariffs. However, in establishing our outlook for the remainder of 2025, we remain cautious as to the uncertainty of the timing, magnitude and ultimate impact of changes in the pricing environment in our industry. We are also cautious concerning the potential adverse impact to consumers and their resulting response in the face of rising prices.”

- Chipotle Mexican Grill ($59.5B, Hotels, Restaurants & Leisure): “Our restaurant teams did an extraordinary job of executing in a challenging environment. While we experienced a slowdown in our underlying trend in May, we did see momentum build as we rolled out our summer marketing initiatives and leaned into hospitality. And exiting the quarter, we returned to a positive comp in transaction trends, which have continued into July. However, considering the ongoing volatility in the consumer environment, we now anticipate comparable sales to be about flat for the full year. As compares ease in the back half of the year, if we could get a little favorability on consumer confidence, which seems to be trending upward in June, July, and then layer in the initiatives that we have in the back half, I have a lot of confidence in the plans we have of getting us back on our front foot very quickly. 2026 is shaping up nicely.”

- Tractor Supply ($31.1B, Specialty Retail): “Despite ongoing macroeconomic uncertainty and a tepid start to spring, our sales performance exceeded our modest expectations. While April was impacted by wet weather and a slow seasonal start, May and June delivered comp sales above the quarterly average, with June marking our strongest comp month of the quarter. We are pleased with the momentum exiting Q2. We recognize the uncertainty that remains from macroeconomic pressures to evolving tariffs. Given our performance year-to-date and our outlook for the balance of the year, we are reconfirming our guidance for 2025. In addition, [product mix] in the second half creates less reliance on big ticket sales. These factors give us cautious optimism as we move into the back half of the year.”

- PulteGroup ($23.1B, Household Durables): “Our results demonstrate that in an operating environment that has grown more challenging, our diversified and balanced operating model offers strategic benefits to help sustain performance. Over the past few quarters, our industry has routinely referenced demand conditions being volatile, and that remains the most accurate description of buyer activity in the first and second quarters…we do see days of strong demand, followed by days displaying a step-down in sign-up activity.”

- Levi Strauss ($8.1B, Textiles, Apparel & Luxury Goods): “As we look to the remainder of the year, we are closely monitoring the evolving tariff dynamics in addition to consumer confidence and behavior. Given the upside in the first half of the year, continued strong execution and momentum in our business, we are raising our top- and bottom-line guidance. While there’s still uncertainty on the macro, largely driven by tariffs, we are in a good position to mitigate the adverse impact given our brand, product, and profitability momentum.”

- Royal Caribbean ($90.8B, Hotels, Restaurants & Leisure): “Our Q2 results exceeded expectations. We are also increasing our earnings guidance for the year, and 2025 is on track to be another record year. Bookings have accelerated since the last earnings call, particularly for close-in sailings. We continue to see engaged and excited consumers with roughly 75% intending to spend the same or more on leisure travel over the next 12 months. At the same time, more than half of consumers tell us they are booking closer to their departure date than they used to. And for the people who intend to travel over the next 12 months, the majority have not yet booked.”

- Genuine Parts ($18.6B, Distributors): “We’re operating in an environment that has presented several challenges, including enacted tariffs and ongoing trade uncertainty, along with high interest rates and a cautious end consumer. That said, we remain cautiously optimistic on market improvement in the back half relative to last year, but likely with a slower pacing versus when we first gave our outlook back in February, which requires us to update [lower] the outlook.”

- Hasbro ($10.5B, Leisure Products): “We delivered a strong Q2, outperforming expectations on revenue, profit and margin all while navigating a dynamic external environment. Based on our strong first half and improved visibility into the back half, we are raising full year guidance.“

- Wyndham Hotels & Resorts ($6.9B, Hotels, Restaurants & Leisure): “We are reaffirming our expectation that full year. As we shared last quarter, we purposefully set a wider range to account for ongoing volatility and uneven demand across markets, and we continue to believe that range remains appropriate Should we see a near-term resolution to global trade tensions, consumer sentiment and demand could recover as quickly as it softened. And with our largest volume months still ahead, we believe this outlook reflects the range of potential outcomes in today’s environment.”

- Brunswick ($4.0B, Leisure Products): “Looking at external factors, we see some areas of continued uncertainty, but also some emerging bright spots compared with Q1. Overall, while we remain mindful of the dynamic macroeconomic backdrop and soft consumer sentiment, there are some reasons for cautious optimismas we progress through early Q3.”

Spotlight on Select Companies that Pulled FY Guidance Last Quarter

- Ford Motor ($44.1B, Automobiles): “Our updated guidance reflects a strong underlying first half performance across our three automotive segments and Ford Credit, including our continued improvement in cost. Our full year outlook assumes a net tariff headwind of about $2B, reflecting approximately $3B of adverse gross adjusted EBIT impact, offset partially by $1B of recovery actions. Given the potential range of outcomes related to how the net tariff headwind will play out by segment, we’re only providing a total company outlook for the remainder of the year.”

- Mattel ($5.6B, Leisure Products): “While there is still volatility due to the global trade environment impacting the U.S. and uncertainty regarding consumer demand in the back half of the year, we are resuming guidance and have updated our outlook for the full year 2025. The industry has momentum entering the second half. We are seeing more certainty. As retailers have more certainty and more visibility into their activities, they are adapting their ordering patterns as well. We lowered the bottom end of our top line guidance, so that has a flow-through impact to the bottom line. You’re also going to see the impact of tariffs flowing through the P&L in the second half. Against this, we have implemented a variety of actions that will help us withstand some of those headwinds.”

- Lear ($5.1B, Automobile Components):“On our Q1 earnings call, we withdrew our 2025 outlook due to significant uncertainty caused by the ongoing international trade negotiations. Over the last few months, industry conditions have somewhat stabilized, allowing us to restore our full year guidance. Our revenue is now expected to be 2% higher than our previous guidance. Core operating earnings are expected to be approximately $20M lower.”

- Deckers Outdoor ($17.5B, Textiles, Apparel & Luxury Goods): “Deckers again delivered another quarter of strong results that came in above our expectations. Given the continued macroeconomic uncertainty related to the global trade policy and difficulty predicting impact on the consumer environment, we are not providing a formal outlook for fiscal year 2026. In terms of how we’re looking at reinstating full year guidance, our intention is to get there. Right now, we’re still looking for greater clarity around the [tariff rates] applied to various countries. We’re also looking at how consumers begin to react to the tariffs. We will likely start to see that in the second half.”

- Polaris ($3.2B, Leisure Products): “We’ve exceeded expectations for the quarter, gained share across our business, and mitigated a portion of the tariff impacts. I’m more confident than ever that we’ll emerge from this cycle stronger because the team is focused and executing on what we can control. Our decision today to not reinstate full year guidance stems from the fact that there remains an abundance of uncertainty around tariffs and the potential impact on consumer spending. We continue to actively monitor developments and will reevaluate our decision on providing full year guidance once we have greater clarity.”

- Harley-Davidson ($2.8B, Automobiles): “Given that the global tariff situation remains ongoing and uncertain, we continue to withhold our full year 2025 financial outlook for HDMC and HDI.”

- Steven Madden ($2.0B, Textiles, Apparel & Luxury Goods): “Q2 was extremely challenging, driven largely by the impact of new tariffs on goods imported into the U.S. Our team moved swiftly to adapt to the changing landscape, sharply diversified our sourcing out of China, negotiating meaningful discounts with suppliers and implementing surgical price increases. That said, wholesale customers canceled orders and reduced open-to-buys. Shipment delays led to lost sales and pushed deliveries to later periods, and organic gross margins declined due to the significant increase in our landed costs, resulting in substantial pressure on both revenue and earnings. Due to the continued uncertainty related to the impact of new tariffs on goods imported into the U.S., we will not be providing 2025 financial guidance at this time.”

Tariffs

Q2 Impacts Limited by Tariff Timing and Early Mitigation Actions, but Companies Brace for Impact – and Increased Margin Headwinds – in the Second Half

- O’Reilly Automotive ($83.1B, Specialty Retail): “Given the existing tariff landscape and our ongoing work with our supply chain partners, we do anticipate further impacts to acquisition costs and are cautious that we could encounter short-term timing headwinds to gross margin rate in the back half of the year depending on the speed with which our industry digests inflation pressures.”

- General Motors ($49.6B, Automobiles): “Turning to tariffs, the environment remains dynamic. The Q2 net impact of $1.1B was slightly lower than we had expected due to the timing of certain indirect tariff costs. As a result, we will likely see Q3 net tariff costs higher than in Q2. For the full year, while there have been some puts and takes since we gave our initial guidance, our gross tariff impact remains unchanged at $4B to $5B as we continue to produce and import vehicles from Canada, Mexico, and Korea to avoid interruptions for our customers and dealers. Over time, we remain confident that our total tariff expense will come down as bilateral trade deals emerge and our sourcing and production adjustments are implemented. We are making solid progress on our mitigation efforts and remain on track to offset at least 30% of this impact with roughly one third coming from each of our key actions: manufacturing adjustments, targeted cost initiatives, and consistent pricing.”

- Tractor Supply ($31.1B, Specialty Retail): “The current tariff landscape is creating some added cost pressure. We’re proactively addressing this by working closely with our supply chain and vendor partners to mitigate the impact. As to timing, we have seen the tariff impact begin to come through on our direct imports. There have been modest cost concessions on the non-direct inventory. At this point, there has been limited impact to the average unit retail. All of this aligns with our expectations that the impacts related to tariffs will primarily occur in the second half of this year and beyond.”

- Deckers Outdoor ($17.5B, Textiles, Apparel & Luxury Goods): “We did not experience a material impact from tariffs in our Q1 because the majority of products sold was either already in inventory or shipped prior to tariffs taking effect. In addition, we implemented selective initial price increases, which went into effect on July 1 and provided no meaningful benefit in the quarter. As a reminder, we plan to phase in product price increases over the course of fiscal year 2026. We’ll see more pressure in the back half on the margin. There’s a dynamic where the tariffs are coming in before our price increases on a full year basis are able to offset that.”

- Hasbro ($10.5B, Leisure Products): “Through the first half of the year, the one piece to keep in mind is that we haven’t seen any of that tariffs impact in the P&L quite yet. So that starts to manifest in the back half of the year, and that’s almost a 2-point drag on our margins as we move through that back half. While tariffs represent a headwind for the business, the current duties are better than the range we discussed in our last earnings call. We are compensating for these costs through a combination of cost reductions, rebalancing our marketing spend, diversifying our supplier mix, and implementing some targeted pricing actions, coupled with a strong slate of new toys.”

- Levi Strauss ($8.1B, Textiles, Apparel & Luxury Goods): “While the situation is still fluid, our guidance assumes an additional 30% tariff on goods arriving in the U.S. from China and an additional 10% tariff on imports from the rest of the world. Our key mitigation initiatives include promotion optimization, targeted pricing actions, vendor negotiations, and further supply chain diversification.“

- Polaris ($3.2B, Leisure Products): “The biggest change from what we spoke about in April would be the tariff on our China spend. This all-in rate is currently at ~55%, which is lower than the 170% that was in place in April. That alone reduces our expected 2025 tariff impact by over $150M. This remains a fluid situation, and we are already implementing actions that can reduce our tariff exposure over the short and long term through our four-pronged mitigation strategy as we continue to reevaluate our supply chain, manufacturing footprint, pricing, and market priorities. We’re targeting to reduce sourced parts from China to the US by 35% by year end, which is slightly higher than what we had initially thought, as the teams have identified even more opportunities to reduce exposure.”

The Consumer

“Hanging In”, But Discerning (a Continuing Trend); Value-Seeking and Big-ticket Deferrals Persist, While Robust Travel Demand Remains a Bright Spot

- Royal Caribbean ($90.8B, Hotels, Restaurants & Leisure): “We continue to see very positive sentiment from our customers, bolstered by strong labor markets, high wages, surplus savings, and elevated wealth levels. Leisure and travel spend continues to grow, and leisure travel continues to be the number one category when consumers plan to increase spending over the next 12 months. We are also seeing strong intent across demographics, particularly among millennials and younger, who continue to represent half of our customer base. Consumers consistently cite cruises as offering excellent value for their money.”

- O’Reilly Automotive ($83.1B, Specialty Retail): “We are cautious concerning the potential adverse impact to consumers and their resulting response in the face of rising prices. We continue to view the consumer as relatively healthy, buoyed by strong employment and wage rate growth. However, we also think that consumers remain cautious in a very uncertain environment and are remaining conservative in the management of their overall household spend.”

- Chipotle Mexican Grill ($59.5B, Hotels, Restaurants & Leisure): “Much of what we’re experiencing right now is due to macro and the consumer. The low-income consumer is looking for value as a price point. Look no further than what’s going on with our competitors with snack occasion or $5 meals. That’s where the consumer is drifting towards because of low consumer sentiment. That’s the biggest headwind we face. It truly is trending along with the macro and consumer sentiment at this point.”

- D.R. Horton ($43.9B, Household Durables): “New home demand continues to be impacted by ongoing affordability constraints and cautious consumer sentiment. Where necessary, we have increased incentives to drive traffic and incremental sales. Our cancellation rate remains at the low end of our historical range, indicating that buyers in today’s market are able to qualify financially and are committed to their home purchase.”

- Mohawk Industries ($7.5B, Household Durables): “A dominant trend across our geographies is consumers’ deferral of large discretionary purchases, which has reduced demand in our industry for almost three years.”

- Whirlpool ($5.5B, Household Durables): “We continued to see consumers choosing to mix into lower end products. The market may look reasonably okay from a unit perspective, the mix in the market is not a healthy one. It’s very strongly a replacement-driven demand and the consumer sentiment just weighs. That’s ultimately a reflection of a broader consumer sentiment and existing home sales, which are very low.”

- Travel + Leisure ($4.1B, Hotels, Restaurants & Leisure): “Demand remains strong across our core timeshare business. We see encouraging engagement from consumers as tour growth improved sequentially from the first quarter and 3% compared to 2024. There’s been plenty of noise around the economy, but from where we sit, our consumers are healthy and prioritizing travel.”

- Harley-Davidson ($2.8B, Automobiles): “Broadly speaking, customers are continuing to seemingly take a pause or wait-and-see-approach based on higher interest rates and overall macro uncertainty. Both factors are having a meaningful impact on our specific customer profile buying patterns. Starting in April, as greater global tariff uncertainty was introduced, it added to the overall economic uncertainty that we experienced in Q1, and it stayed with us through most of Q2.”

- Steven Madden ($2.0B, Textiles, Apparel & Luxury Goods): “Overall, the consumer is basically hanging in there. It’s not the most robust consumer spending environment for fashion I’ve ever seen, but it’s okay.”

Costs & Pricing

Companies Take Cautious Approach to Tariff-Driven Price Increases, Watching Closely for Demand Sensitivity and “What the Consumer Can Bear”

- O’Reilly Automotive ($83.1B, Specialty Retail): “Should consumers face rapid broad-based price increases in the back half of the year, we could encounter short-term reactions, particularly by lower-income DIY consumers who may look to ease pressure by cutting back on spending wherever possible. From our perspective, what gives us more caution is less any price sensitivity or elasticity around the prices we move up, but just the broader pressure that inflation across all of our customers pocketbook spend can have.“

- Genuine Parts ($18.6B, Distributors): “Our industry demand remains driven by break-fix customer needs, which results in an ability to pass through prices, and the competitive activity in our industries remains rational. While we have not seen significant signs of demand destruction at this point, as tariffs continue to auger into the broader economy, we will be watching closely for any change in customer behavior.”

- Deckers Outdoor ($17.5B, Textiles, Apparel & Luxury Goods): “Since we increased prices on July 1, we haven’t seen any material decline in performance for the products that we have raised price on. We’re mindful that consumers are just beginning to feel the impact of higher prices, and we’ll remain nimble to react to changes in the consumer environment.”

- Hasbro ($10.5B, Leisure Products): “You started to see some indications that toy prices were starting to creep up in May and June. That will happen slowly and consistently, likely through the balance of the year and into next year. I don’t think you’re going to magically see one day toy prices go from X to Y. It’s going to over several months as the general industry gets a feel for what the consumer can bear.”

- Mohawk Industries ($7.5B, Household Durables): “The question to the whole economy is if you push all this price through, what’s going to happen to the consumer and buying and is it going to be enough to stop it?”

- Mattel ($5.6B, Leisure Products): “Our goal is to keep prices as low as possible for our consumers. We have already implemented pricing actions that were necessary in our U.S. business in very close collaboration with our retail partners. We feel very confident that that is behind us.”

- Steven Madden ($2.0B, Textiles, Apparel & Luxury Goods): “We are selectively raising prices to wholesale customers and consumers. So far, we’ve been pleased overall with consumer acceptance of the price increases, particularly on new fashion, but it’s still early. We will continue to monitor the elasticity of demand carefully and react accordingly.”

OBBBA Impact

Bonus Depreciation and Tax Relief Cited as Key Tailwinds, with Some Quantifying FCF and Capex Benefits; Flow-Through from Consumer Uptake of New Incentives Still TBD

- Pool Corp ($11.9B, Distributors): “The biggest benefit is the change in the accelerated depreciation. That will be a positive as it relates to the cash flows on the tax side. On the homeowners, I don’t know that we’ll be able to see any type of quick reaction on that. Most people, I would suspect, are still digesting the impact. And we really haven’t seen any significant changes in consumer confidence or spending of discretionary income at this point.”

- Penske Automotive Group ($11.0B, Specialty Retail): “While we continue to evaluate the impact of the One Big Beautiful Bill on our financial statements, we do expect to recognize positive cash flow impacts related to our 28.9% ownership in the PTS partnership. Bonus depreciation, in particular, will provide an estimated benefit of ~$150 million, and a $3B worth of capex in trucks that PTS expects to purchase in each of the next three years and beyond.”

- Churchill Downs ($7.8B, Hotels, Restaurants & Leisure): “We expect improvement in our FCF from favorable cash taxes because of the federal tax bill that was signed on July 4th. The new tax provisions include making the 21% business tax rate and the 100% bonus depreciation rule permanent. The additional interest deductions combined with 100% bonus depreciation will reduce our cash taxes and increase our FCF this year and in future years. We expect that the impact of lower cash tax payments in 2025 will be $50M to $60M.”

- Boyd Gaming ($7.0B, Hotels, Restaurants & Leisure): “[Regarding OBBBA and no tax on tips and overtime], I don’t think we are in a position to go out and talk about what we think that that means to the company. Certainly, it impacts a lot of our customers here in Las Vegas, as well as customers around the country who visit our properties. So, it clearly is a positive for us. We’ll wait and see how it all plays out. New tax brackets are all going to benefit us going forward. We’re just not sitting here today in a position to quantify that for you.”

- Taylor Morrison Home ($6.0B, Household Durables): “I would point to the Big Beautiful Bill and some of the benefits with the SALT deduction cap temporarily lifted, the permanence of the $750,000 on mortgage interest that now won’t expire. Some of those things will help the consumer.”

- Brunswick ($4.0B, Leisure Products): “The One Big Beautiful Bill Act favorably addressed tax increases that were previously scheduled to take effect and restored key pro-business provisions, such as full expensing of U.S. R&D. We are still analyzing the impact of all these changes on a global basis but anticipate a significant positive cash flow impact moving forward.”

- Harley-Davidson ($2.8B, Automobiles): “Following productive engagement with the U.S. administration, we are pleased that Harley-Davidson motorcycles have been included in the recently signed automotive tax reduction legislation, part of the broader economic bill. Under the new law, interest paid on loans for new U.S. built motorcycle purchases up to $10,000 annually is tax deductible when all vehicle and customer eligibility criteria are met. We believe this will have a positive effect and stimulate demand as a tax incentive takes hold in the market.”

- Mister Car Wash ($2.0B, Diversified Consumer Services): “We held off on executing sale leasebacks in Q2 as we awaited clarity on the One Big Beautiful Bill Act. As we suspected, following its passage and the restoration of 100% bonus depreciation incentive to buyers versus 40% prior, we’ve seen a marked increase in demand for our assets. We are now entering into deals on significantly improved terms compared to last year.”

Around the World

U.S. Resilience Persists; Europe and China Remain Pressured, While APAC and Latin America Present Growth Opportunities

- eBay ($35.7B, Broadline Retail): “Demand in the U.S. continues to be more resilient and we’ve seen healthy volume trends so far in Q2. As it pertains to Europe, particularly Germany and the UK, leading indicators in the UK like consumer confidence remain depressed. There continues to be concerns over cost of living and inflation, which in our second largest market is obviously quite pertinent.”

- Genuine Parts ($18.6B, Distributors): “Our Canada team is continuing to outperform the market despite an ongoing soft macro environment. In Europe, total sales were flat in local currency, with comparable sales down approximately 1%. The team in Europe is working aggressively to navigate a muted market, payroll and rent inflationary pressures, and a fluid geopolitical backdrop.”

- Hasbro ($10.5B, Leisure Products): “As anticipated, Consumer Products sales were down in the quarter, particularly in North America, where our retail partners made a shift in ordering from direct imports to domestic, given the uncertainty around tariffs over the last few months. We expect to make up much of this delayed ordering in Q3 and into Q4 as sales ramp into the holidays. EMEA and APAC are performing well, and we anticipate each of these regions will end the year in growth mode.”

- General Motors ($49.6B, Automobiles): “From a China perspective, now that we announced the restructuring last year and it’s on track, very proud of the fact that the team is gaining share. From a Europe perspective, there are a lot of changes that are happening right now from a regulatory perspective and from a competition perspective, especially from the Chinese. Over time, that will settle out. We think we have an opportunity in that market. In South America, we have a huge opportunity, as well as in the Middle East.”

- Domino’s Pizza ($16.0B, Hotels, Restaurants & Leisure): “International retail sales grew 6%, excluding the impact of foreign currency in the quarter. We have not seen any material impacts to date from global macro or geopolitical uncertainty. In the quarter, we saw strength in Asia that was due to continued strong comps in India and in our Americas region, which was driven by Canada and Mexico.”

- LKQ ($7.8B, Distributors): “In North America, we are anticipating a delayed recovery in repairable claims, ongoing tariff disruptions and competitive market dynamics. In Europe, persistent economic softness, geopolitical unrest and ongoing U.S. trade negotiations are all drivers of an uncertain environment…we are no longer anticipating market improvements.”

- Autoliv ($8.8B, Automobile Components): “In North America, the production outlook has been significantly downgraded due to the trade risks and higher vehicle prices from import tariffs, especially for the fourth quarter. This reduction is likely to affect vehicles produced in Mexico and Canada more severely.”

- Whirlpool ($4.7B, Household Durables): “We continue to see demand improvement in India, however, behind initial expectations due to geopolitical tensions and an unusually cool summer selling season in Q2.”

In Closing

The Consumer Discretionary sector continues to weather a challenging and volatile trade policy environment. While a sense of “cautious optimism” has emerged, companies are actively managing tariff-driven cost pressures and discerning consumer spending patterns. Further, while markets have soared to new highs, commentary from management teams across the sector this earnings season provides another reminder that we are not yet out of the woods.

We will continue to highlight developing themes in our ongoing weekly earnings Sector Beat coverage to provide insightful information on the macroeconomic landscape and factors impacting market sentiment.

- $1B in market cap

- As of 4pm ET 7/30/25