Commencing the Quarter – Q2’25

15 min. read

Another earnings season is just around the corner, and investors are sure to be scrutinizing Q2 results and probing for insights into how companies are navigating the evolving and complex macro landscape. Next week, we’ll be publishing our 63rd issue of Inside The Buy-Side® Earnings Primer®, offering a timely look at current investor sentiment amid this period of ongoing uncertainty.

This week, our Thought Leadership covers:

- Key Events this week

- Q2’25 Earnings Communication Summary, based on a review of company earnings to date

Key Events

Employment

- U.S. nonfarm payrolls rose by 147,000 in June, well ahead of economist expectations for 106,000 and topping estimates for a fourth straight month. The unemployment rate unexpectedly fell to 4.1% from 4.2% versus expectations that it would tick up to 4.3%. (Source: Bureau of Labor Statistics)

- U.S. initial jobless claims edged lower to 233,000 for the week ended June 28, below 240,000 consensus and down from the prior week’s 237,00 level. Continuing claims for people receiving benefits held steady 1.964M for the week ended June 21, which is the highest level since the fall of 2021. (Source: Labor Department)

- Wednesday’s ADP report showed private payrolls unexpectedly fell by 33,000 jobs in June, well short of economist estimates for a 95,000 increase. The prior month’s reading was also revised down to a 29,000 increase from the 37,000 gain initially reported. The report added that while layoffs remain rare, “a hesitancy to hire and a reluctance to replace departing workers led to job losses last month.” (Source: ADP, Reuters)

- The monthly report from Challenger, Gray & Christmas revealed that U.S.-based employers announced 47,999 job cuts in June, down 49% from May’s 93,816 reading. The report added that Q2 saw 247,256 job cuts, up 39% YoY but down 50% from the 497,052 cuts announced in Q1. (Source: Challenger, Gray & Christmas)

ISM Manufacturing & Services

- U.S. manufacturing activity contracted for a fourth straight month in June, indicating continued uncertainty surrounding tariffs and their impact on costs. The ISM said Tuesday that its Purchasing Managers’ Index of manufacturing activity rose to 49.0 in June, from 48.5 in May. A PMI reading below 50.0 indicates contraction in the manufacturing sector. (Source: Institute of Supply Management, WSJ)

- Thursday’s ISM services report showed that the institute’s Non-Manufacturing PMI rose to 50.8 in June, up from 49.9 in May. Economists polled by Reuters had forecast the services PMI rising to 50.5. (Source: Institute of Supply Management, Reuters)

Global Trade

- Canada and the U.S. agreed to resume trade talks this week following an announcement from Prime Minister Carney over the weekend that Canada would rescind its digital service tax on U.S. tech companies. The move came after President Trump criticized the tax last Friday, stating that all trade discussions with Canada would be terminated. (Source: Axios, CNBC)

- On Wednesday, President Trump announced via Truth Social that a trade agreement had been struck with Vietnam. Details include a 20% tariff rate on Vietnam exports to the U.S., and a 40% tariff on goods deemed to be trans-shipped through the country, while Vietnam agreed to drop all levies on U.S. imports. (Source: Reuters)

- On Tuesday, President Trump reiterated his resistance to extending the reciprocal tariff pause beyond July 9 and expressed doubts about being able to reach a deal with Japan. He also suggested the White House may simply send letters to many countries informing them of their new tariff rates. On the more positive side, reports suggest the U.S. is nearing deal with India and the EU, perhaps reaching agreements before next week’s deadline. (Source: Bloomberg)

U.S. Politics

- The U.S. House of Representatives appears poised to pass the Trump Administration’s One Big Beautiful Bill Act after House Speaker Johnson overcame resistance overnight from conservative holdouts — a final vote is planned for today. If cleared, the bill will move to President Trump’s desk to be signed into law ahead of his self-imposed July 4th deadline. (Source: WSJ, CNBC)

Q2’25 Earnings Communication Digest

Every quarter, we analyze earnings communication trends for off-cycle companies reporting over the past month to identify important themes and precedence. These companies span market cap sizes and sectors.

In-line with preliminary findings from our Inside The Buy-Side® Earnings Primer® — to be released Thursday, July 10 — earnings commentary reflects a generally balanced tone, with executives remaining cautious due to ongoing macro uncertainty, yet expressing optimism about their ability to adapt and manage near-term headwinds.

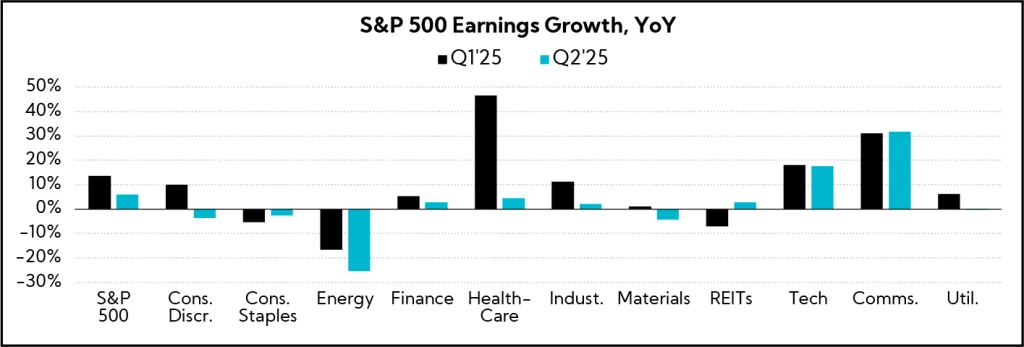

While tariff impacts have yet to drive a meaningful rise in inflation, analysts continue to expect flow-through in the months ahead, and questions remain about companies’ ability to pass on higher prices amid a softer demand backdrop, cooling labor market, and an increasingly fragile consumer. Indeed, as noted in our Q1’25 Closing the Quarter piece, while first quarter earnings came in largely better than expected, a look at consensus estimates for the S&P 500 shows a marked deceleration in earnings growth expectations for Q2, with margins expected to be pressured.

After delivering YoY earnings growth of 13.7% in Q1’25, estimates point to growth of 5.9% in Q2 for the Index, driven by the Communications and Technology sectors, while several sectors are expected to report YoY declines.

At the same time, equity markets have largely shaken off April/May tariff turmoil and June’s Iran/Israel conflict, with the S&P 500 having more than recouped “Liberation Day” losses and closing out 1H’25 at a new all-time high. Meanwhile, the July 9th reciprocal tariff deadline looms — with few trade deals yet to be reached — and it remains to be seen how the global trade landscape will unfold in the coming weeks and months.

Against this backdrop, executives are striking a measured stance toward the second half, with even those that delivered strong Q1 results tempering outlooks and preparing for a range of outcomes.

Regarding tariffs, companies continue to detail expected impacts and progress with mitigation strategies, touting flexible “in-region for-region” supply chains, diversified sourcing, and targeted pricing actions. Further, several companies framed price increases as a “last resort”, with the bulk of those coming from consumer-facing industries. Notably, numerous companies flagged an acceleration in the trend of higher-income consumers shifting toward value-seeking behavior.

On the demand front, trends vary across sectors and end markets. Executives point to elevated interest rates, a weak Spring housing market, downbeat consumer sentiment, and cautious corporate spending patterns among myriad headwinds, while areas tied to AI-driven demand remain strong, including data centers and technology solutions aimed at driving productivity and efficiency improvements.

Commentary reveals companies are taking a hard look at costs and “prudently” managing expenses in the near term, while still making strategic investments to streamline operations and deliver long-term profitable growth. At the same time, execs continue to highlight downturn playbook levers at their disposal to offset headwinds should conditions deteriorate further.

Globally, the picture is mixed, with India and Latin America exhibiting strength, offsetting weaker trends in North America. Demand in Western Europe remains largely challenged, albeit with increased defense spending cited as a bright spot. Views toward Southeast Asia are more upbeat, though China’s recovery remains uneven amid ongoing consumer pressures.

Earnings Topics

Key trends from our analysis of off-cycle earnings calls include:

Macro & Outlook

Uncertainty Remains amid “Volatile” Macro Conditions, Tariffs, and Consumer Fragility; Execs Balance Cautious Guidance with Confidence in Ability to Adapt

- Accenture ($184.4B, IT Services): “Stating the obvious, we continue to see a significantly elevated level of uncertainty in the global economic and geopolitical environment as compared to calendar year 2024. In every boardroom, in every industry, our clients are not facing a single challenge; they are facing everything at once. Economic volatility, geopolitical complexity, and major shifts in customer behavior.”

- FedEx ($54.8B, Air Freight & Logistics): “[Regarding guidance], the trade environment is the primary reason that we are focused on Q1 versus a range for the entire year. We simply cannot predict how that’s going to play out. We built the range based on the current trade and tariff environment. When we talked about the headwind on tariffs, the vast majority of that is impact from China to the U.S. I think over the next 30 to 60 days the trade environment will change. So, we will see how that evolves, and at that point we’ll be able to be more prescriptive.”

- Ferguson Enterprises ($43.8B, Trading Companies & Distributors): “Our markets remain dynamic and uncertain, but given the strong performance in the quarter, we are updating our full year guidance. We now expect low- to mid-single-digit revenue growth, up from our prior expectation of low-single-digit growth. And we expect an operating margin range of 8.5% to 9.0%, up from our prior expectation of 8.3% to 8.8%. We still have a fairly wide range for the full year, and that’s because we’re still in an inherently uncertain time with many uncertain external variables, such as tariff changes or industry-announced price increases that either get pushed forward or rolled back in the very near term. It’s a bit more dynamic than the typical environment.”

- General Mills ($27.3B, Food Products): “As we head into fiscal 2026, we expect the operating environment will remain volatile, with consumers pressured by widespread uncertainty from tariffs, global conflicts and changing regulations. Amid this uncertainty, we expect consumers to remain cautious and continue seeking value, prioritizing their spending on benefits that matter most to them.”

- Hewlett Packard Enterprise ($26.8B, Technology Hardware, Storage & Peripherals): “We reported EPS of $0.38, ahead of our outlook, driven in part by a more moderate tariff impact and operational benefits. However, we continue to navigate a complex macroeconomic and geopolitical landscape and remain prepared to take additional action in the back half of the year to deliver against our fiscal 2025 outlook.”

- Dollar Tree ($20.8B, Consumer Staples Distribution & Retail): “While 2025 is shaping up to be a more complicated year than we initially anticipated, we are encouraged by our strong sales trends, driven by our attractive value proposition and multi-price efforts. We remain confident in our ability to navigate our way through the current environment and still achieve our profitability goals for the year.”

- Core & Main ($11.2B, Trading Companies & Distributors): “We have good visibility into demand through the next quarter and expect to finish the first half strong, supported by healthy project activity and backlogs. That said, uncertainty associated with tariffs, inflation and interest rates could impact customer sentiment and demand in the back half of the year. At a high level, we continue to expect our end markets to be roughly flat for the full year, stable in the near term, but with less clarity as we move into the second half.”

- Donaldson ($8.1B, Machinery): “As far as fiscal 2026, obviously we’re going to be smarter in 90 more days given the dynamic environment. Our company just had a record quarter yet again, while our OE end markets have headwinds and are declining somewhat in the On-Road and agriculture sectors. We are poised when the overall economic cycle takes up to really leverage that and our company is in a solid position and executing exceptionally well as we look to 2026 in our plans. And that’s the type of plan that we’ll put together for you and we’ll talk about here in about 90 days.”

- Academy Sports and Outdoors ($3.0B, Specialty Retail): “While we’re excited about the progress we’re making against our long-term initiatives and the momentum we’re starting to see in the business, we’re also sober about the fragile state of the U.S. consumer and the inflationary pressures it could face as the year progresses. As noted in our Q1 fiscal 2025 earnings release, we are widening our comp sales guidance to account for an expanded range of outcomes.”

Demand

Uneven Trends with Elevated Interest Rates, a Soft Housing Market, and Macro Uncertainty Serving as Drags; Data Centers and AI-driven Demand Remain Bright Spots; Mixed Signals on Tariff-induced Pull-forward

- Accenture ($184.4B, IT Services): “I am talking to CEOs every day, and there was this whole narrative about a pause and sitting on the sidelines. And what I would tell you is it was very short. Our clients have moved from pause to focus and leapfrog. Focus being they want to do the biggest things that are going to make a difference even more. And that’s what you continue to see in these large bookings and big deals. Leapfrog is this whole idea of AI, like how can we be the first, how can we lead?”

- Paychex ($50.8B, Professional Services): “We see in our interactions in the market that the uncertainty is prompting businesses to exercise caution when making decisions and being cautious about how much they are spending on products and services. We have also seen an increase in bankruptcies and financial distress in the micro end of the market. Businesses on the edge of failure may have decided not to fight the new headwinds they see in front of them. We also saw losses due to increases in business combinations and mergers more than typical. Both are signs of businesses making strategic decisions based upon their view of the current and future environment.”

- Ferguson Enterprises ($43.8B, Trading Companies & Distributors): “The data center activity remained strong and as we look across that funnel of opportunities, the overall landscape appears to continue to grow. And although we keep our eyes open for any pause in activity or any cancellation of projects, we still feel good about what’s going on there. That’s really the strength in the non-residential market as the traditional side of the house is still in a challenging spot.“

- Lennar ($29.0B, Household Durables): “The well-documented softness of the Spring selling season showed the impact of affordability challenges, driven by higher interest rates and elevated home prices, along with the uncertainty associated with the macro environment. As the [housing] market softened, we leaned into our people and processes to find market and maintain sales pace.”

- Jabil ($23.4B, Electronic Equipment, Instruments & Components): “The bulk of our revenue beat was in capital equipment and in the cloud data center infrastructure. Both of those are U.S. centric. Tariff impact is minimal there, so I don’t expect to see any pull-ins. Beyond that, we’re not seeing pull-ins of any magnitude. The whole tariff situation is still fluid. Nobody wants to make decisions based on paying too much of a tariff or too little. We’re obviously having a lot of discussions, but no pull-in of significance.”

- CarMax ($10.0B, Specialty Retail): “I would go back to some remarks I made in the last quarterly call, which is the quarter started off strong and then we saw an uptick at the end of the quarter when there was speculation about the tariffs. Rolling into April, we saw another little uptick. And so, April ended up being the strongest month for us.”

- Acuity Brands ($9.3B, Electrical Equipment): “On the ABL side, we do believe there’s some evidence of order acceleration. You can see the strong growth in the disaggregated revenue and basically all of our controlled environment, so the independent sales network and direct sales. So, that would indicate that there was some pull-forward, and we’re evaluating that demand through the rest of the period.”

- GMS Inc. ($3.8B, Trading Companies & Distributors): “Commercial activity continues to be negatively impacted by high interest rates, the lack of available financing, and general economic uncertainty contributing to soft starts. We expect this dynamic to continue but moderate, with some recovery in our business towards the first half of calendar 2026. This assumes we see rates decrease as expected and generally improved confidence in the direction of the economy. Strength continues to come from larger projects and those that are not as dependent on private financing, particularly those in public education, health care, and technology. Notably, we have a data center backlog that extends well into 2026, and there is no indication of these projects slowing down.”

Operational Balancing Act

Companies Navigate Uncertainty by “Prudently” Managing Costs While Investing Strategically for Profitable Long-term Growth

- Ferguson Enterprises ($43.8B, Trading Companies & Distributors): “While we’re in a dynamic and uncertain environment, we remain confident in our markets over the medium term. We continue to balance investment in key strategic opportunities, leveraging multiyear tailwinds in both residential and non-residential end markets as we look to support the complex project needs of our specialized professional customers. Our intentional balanced end-market exposure and focus on key growth initiatives continue to position us well in both the current environment and well into the future.”

- Lennar ($29.0B, Household Durables): “While the short-term road ahead might seem choppy, we are very optimistic about our future. This is a tough time to be spending heavily on innovation, but we are. We are building what will become a stronger margin driving platform by using volume to enable us to drive costs down across our platform. We know this takes time, but we also know it will help build a healthier housing market and position Lennar for bottom-line growth even as the market remains soft. Admittedly, we haven’t gotten there yet, but we believe that we’re getting very close to the bottom and the time when we will build back margin from a lower cost structure.”

- Lululemon Athletica ($27.8B, Textiles, Apparel & Luxury Goods): “While we recognize that Q2 has some pressures related to our planned business investments and additional expenses related to tariffs, we feel good about the full year and our ability to maintain our revenue guidance for 2025. Given the uncertainties in the macro environment, our approach to planning remains balanced on managing the dynamics of the current year, while also maintaining our focus on the long term. We are managing expenses prudently, while also continuing to invest to drive long-term growth and set ourselves up for future success.”

- The Campbell’s Company ($9.2B, Food Products): “We’re building a stronger foundation for the future by improving our efficiency and effectiveness across the organization to facilitate growth. We have hired a Chief Digital and Technology Officer to accelerate digital tools and capabilities to improve our efficiency and effectiveness. Finally, we remain focused on identifying incremental productivity and cost savings opportunities to create more fuel to invest in our brands. All told, our focus remains firmly on disciplined short-term execution as we lay the groundwork for consistent, sustainable growth.”

- Donaldson ($8.1B, Machinery): “Earnings growth has outpaced sales growth for seven quarters in a row, due in large part to operating margin expansion. We continue to make long term investments in the company with sharp prioritization of technology opportunities and targeted capital expenditures.”

- Five Below ($7.2B, Specialty Retail): “We’re looking at the back half of the year with great prudence. Every action we’ve taken thus far will apply to the back half of the year. With that said, we acknowledge that there still is macroeconomic uncertainty. And so, we wanted to take a very prudent approach to how we guided for the back half of the year.”

- RH ($3.6B, Specialty Retail): “To mitigate risks, we are delaying the launch of the new concept that was planned for the second half of 2025 to the spring of 2026, when there is more certainty regarding tariffs and price of product. Additionally, due to significant and unexpected Liberation Day tariffs announced on April 2, shipment and sourcing efforts were disrupted globally. We believe the disruption will negatively impact revenues by approximately 6 points in Q2 and will be recovered in the second half, reflected in our outlook.”

- PVH Corp ($3.1B, Textiles, Apparel & Luxury Goods): “As I discussed last quarter, we expect to drive significant cost savings connected to our Growth Driver 5 actions, with savings showing up more powerfully as we progress through the year. These actions will simplify our operating model to drive more efficient ways of working, focus on our global technology stack, our global distribution network, our operating model in Europe, and our support functions. We expect these actions to deliver 200 to 300 bps of operating margin expansion over time and expect to exit 2025 with approximately 200 bps of this savings realized.”

- La-Z-Boy ($1.5B, Household Durables): “In fiscal 2026, we expect consumers to be challenged by the volatile macroeconomic environment, and we are planning prudently to navigate the year ahead while still expecting to continue outperforming the industry.”

Tariffs & Mitigation

Companies Leverage Supply Chain Flexibility, Diversified Sourcing, and Pricing Strategies to Manage Impact through 2025 and Beyond; Some Frame Raising Prices as “Last Resort”

- Nike ($92.3B, Textiles, Apparel & Luxury Goods): “These tariffs represent a new and meaningful cost headwind, and we are taking actions that balance the consumer, our partners, our Win Now actions, as well as the long-term positioning of our brands in the marketplace. First, we will optimize our sourcing mix and allocate production differently across countries to mitigate the new cost headwind into the U.S. Second, we are partnering with our suppliers and our retail partners to mitigate this structural cost increase to minimize the overall impact to the consumer. Third, we have implemented a surgical price increase in the U.S., with phased implementation beginning in fall 2025. And last, we will evaluate corporate cost reduction as appropriate.”

- Kroger ($47.4B, Consumer Staples Distribution & Retail): “As a domestic food retailer, we expect a smaller business impact than some of our competitors. Where we do see potential tariff impact, we are proactively looking for ways to avoid raising prices for our customers, and we consider price changes as a last resort.”

- Dollar General ($24.8B, Consumer Staples Distribution & Retail): “While we have relatively low exposure, we are working diligently to mitigate the impact of current tariffs, using many of the same tactics that we used successfully in 2018 and 2019. These actions include working with our vendor partners to reduce costs in a variety of ways, including negotiating cost concessions, shifting manufacturing to other countries where possible, re-engineering products or finding substitute products. While the tariff landscape remains dynamic and uncertain, we expect tariffs to result in some price increases as a last resort, though we intend to minimize them as much as possible.”

- Ciena ($11.5B, Communications Equipment): “Under this current tariff structure, we expect the total cost of tariffs to be approximately $10M per quarter. We expect to mitigate most of the impact as compared to Q2. If other schemes come in place and the potential for tariffs go up, we do have a range of things that we could do. We could move manufacturing operations. We could change flows in our supply chain. With respect to passing on to customers, it’s going to be a complicated situation because not in all cases are we going to actually pass a tariff along to them.”

- Acuity Brands ($9.3B, Electrical Equipment): “Over the last several years, we have diversified our supplier options and locations. During the quarter, we leveraged these options to move away from higher tariff environments. We also took strategic pricing actions intended to cover the dollar impact of the tariffs while remaining competitive in the marketplace. Finally, where we could, we accelerated productivity efforts to reduce expenses.“

- The Campbell’s Company ($9.2B, Food Products): “We have estimated the net incremental headwind of tariff-related costs to be up to $0.03 to $0.05 per share to fiscal 2025 adjusted EPS. This estimate reflects our assumption that the current tariff actions stay in place and incorporates the proactive steps we’re taking to minimize overall impact, including strategic inventory management, working in close partnership with our suppliers, pursuing alternative sourcing and product cost optimization, and where absolutely necessary, consideration of surgical pricing actions.”

- Donaldson ($8.1B, Machinery): “Our operating model provides some natural hedging from tariff impacts. First, about 75% of our footprint is in region to support region manufacturing and distribution. Second, our largest exposure is from Mexico to the U.S., where approximately 85% of goods we ship are USMCA qualified. On an annualized basis, we estimate the total impact of tariff costs to be around $35M, which we expect to offset through supply chain and price adjustments, including the application of surcharges.”

- RH ($3.5B, Specialty Retail): “We have continued to shift sourcing out of China and expect receipts to decrease from 16% in Q1 to 2% in Q4 with a meaningful portion of the tariff absorbed by our vendor partners. We’ve also re-sourced a significant portion of our upholstered furniture to our own North Carolina factory. We’re now projecting that 52% of our upholstered furniture will be produced in the U.S. and 21% will be produced in Italy by the end of 2025. While there remains uncertainty, we have proven we are well positioned to compete favorably in any market conditions.”

- Academy Sports and Outdoors ($3.0B, Specialty Retail): “We have further accelerated our efforts and reduced [China sourcing] down to roughly 6% by the end of the year versus our original goal of 8%. We’ve also leveraged our strong balance sheet pulling domestic inventory on evergreen product at pre-tariff prices. Next, we utilized our pricing optimization engine to look for opportunities to offset cost increases through strategic pricing and promotional adjustments. At this point, we believe we’ve effectively mitigated cost of tariffs at their current levels while minimizing the impact on our customers.”

The Consumer

Cautious Spending Trends and Trade-downs Continue as Higher-income Groups Flock to Value Retailers to Stretch Budgets

- Kroger ($47.1B, Consumer Staples Distribution & Retail): “We’re seeing some discretionary spend that’s a little softer in areas like snacks and adult beverages, pet, the general merchandise categories. We expect the consumer to remain cautious throughout the year, and we’re responding to that with simpler promotions, coupons, lower prices, and a lot of Own Brand choices.”

- Lululemon Athletica ($27.8B, Textiles, Apparel & Luxury Goods): “My sense is that in the S., consumers remain cautious right now, and they are being very intentional about their buying decisions.”

- Darden Restaurants ($25.3B, Hotels, Restaurants & Leisure): “What we’re seeing is that the higher income [consumer] is doing a little bit more than the lower income in general. Across our segments, as you move up to incomes in the $100,000 to $150,000 households, that’s where we’re seeing more growth. When you look at it in aggregate, pretty much every household income is growing in casual dining except for the ones below $50,000 where it’s kind of flattish.”

- Dollar General ($24.8B, Consumer Staples Distribution & Retail): “While our core customer remains financially constrained, we have seen increased trade-in activity from both middle- and higher-income customers. Our data shows that new customers this year are making more trips and spending more with us compared to new customers from last year, while also allocating more of their spend to discretionary categories. We believe these behaviors suggest we are continuing to attract higher income customers who are looking to maximize value while still shopping for items they want and need.”

- Dollar Tree ($20.8B, Consumer Staples Distribution & Retail): “In recent quarters, higher income customers have been a meaningful growth driver for us. In Q1, we had measurable sales improvement across all income levels, with the most growth coming from our higher income customers. In particular, we saw a meaningful traffic increase from customers with household incomes of more than $100,000.”

- Casey’s General Stores ($18.7B, Consumer Staples Distribution & Retail): “We’re seeing good strength from the higher-income consumers, those making over $100,000 a year. And then, even on the low-end, we are seeing that traffic hang in there, but they are modifying some purchasing behavior.”

- The Campbell’s Company ($9.2B, Food Products): “In the current dynamic macro environment, consumers are making thoughtful spending decisions, which is materializing in our categories. Consumers continue to cook at home and focus their spending on products that help them stretch their food budgets, and they’re increasingly intentional about their discretionary snack purchases.”

- Academy Sports and Outdoors ($3.0B, Specialty Retail): “We continue to see an increase in foot traffic from customers [with] household incomes over $100,000 annually. This is a pattern we’ve seen emerge over the past couple of quarters and it is starting to accelerate. We would expect this trend to continue as customers look to stretch their discretionary spending power by seeking out value.”

Around the World

Regional Trends Diverge with India and LatAm Standout Growth Engines Amid a Softer Backdrop in North America and Europe; Some Bright Spots in Asia, Though China Recovery Remains Uneven

- FedEx ($54.8B, Air Freight & Logistics): “The [trade] patterns are changing as we speak. And clearly, we are seeing growth from Southeast Asia, for example, Vietnam. We’re looking at Asia to Europe as an opportunity. Latin America inbound markets are growing, and markets like India are growing substantially. The complexity is increasing. The environment is changing, but here is where we get to flex our scale.”

- Adobe Inc ($163.3B, Software): “Q2 growth drivers for creative and marketing professionals included growth of Creative Cloud flagship offerings with particular strength in emerging markets driven by Latin America, India, and Eastern Europe.”

- Donaldson ($8.1B, Machinery): “Touching on China for a moment. Mobile Solutions China sales were a bright spot in the quarter, increasing 27% from growth in both first-fit and aftermarket. We are pleased with the momentum we are seeing, particularly in Off-Road as a structural shift to larger, more sophisticated equipment is driving demand for our products. We’re optimistic about our long-term growth potential.”

- Greif ($3.8B, Containers & Packaging): “Demand remained stable across all regions outside North America. In North America, softness persisted due to greater exposure to industrial end markets.”

- PVH Corp ($3.1B, Textiles, Apparel & Luxury Goods): “Despite the continued muted consumer backdrop [in Europe], we drove better conversion across the region, with particular strength in the big consumer moments. What we have seen over the past three months is a tougher consumer and macro backdrop, especially in North America. The China backdrop from a consumer sentiment perspective is continuing to be tough and coming down. We are not yet in a place where we can fully offset that.”

- Enerpac Tool Group ($2.4B, Machinery): “We are benefiting from major rail projects and maintenance needs in Thailand, Japan, and the Philippines. We also see growth opportunities in solar farms in Vietnam and wind projects in Japan. At the same time, there are some more challenged end markets, including the steel industry in South Korea and refining and petrochemicals in China. In the EMEA region, we are seeing strength from the infrastructure market and are benefiting from higher defense budgets, spending in the oil and gas sector, and ongoing wind projects. However, we are seeing some softness in our service revenue in Europe, an effect of an overall economic slowdown in Western Europe.”

- Lindsay Corp ($1.6B, Machinery): “In our international irrigation markets, particularly Brazil, we’re encouraged by continued signs of improving market conditions. I traveled across Mato Grosso and Goias states earlier this month and can confirm that customers in this region are ready to expand irrigated acres as the availability of affordable credit expands and the country’s energy infrastructure grows.”

- Steelcase ($1.2B, Commercial Services & Supplies): “There’s definitely growth on the horizon, especially with China now starting to show couple quarters in a row of order growth. It feels like we are coming off the bottom. And India remains an incredibly strong market for us.”

In Closing

While recent earnings calls echo many of the big themes seen during the height of Q1 earnings, they also contain glimmers of improved sentiment relative to the April/May reporting timeframe. Though executives remain guarded in their outlooks, fears of an all-out global trade war have dissipated, and investors appear to have drawn confidence from mitigation steps outlined by companies to date. Important to note, however, mitigation efforts are generally not supportive of economic growth.

In the coming weeks, we’ll gain more clarity around what a post-90-day-pause reciprocal-tariff environment entails, with implications for corporate planning. In addition, big banks are set to kick off Q2 earnings season on July 15 and will shed light on the global economy, consumer, and deal environment.

In the meantime, businesses remain squarely focused on controlling costs, the labor market appears stalled in a “no-hire/no-fire” zone with increasing instances of companies implementing “back to the office” programs, resulting in unforced reductions in force, and the broader demand backdrop is far from robust (outside of AI and other segments benefiting from structural tailwinds). As such, it remains imperative to strike the right balance between acknowledging uncertainty and reinforcing preparedness in your communication with the Street. We’re not out of the woods yet and the signs are pointing to a slow burn toward impact.

As noted above, keep an eye out for our Q2’25 Earnings Primer®, which we’ll publish next Thursday, July 10.